Audrey Galawu- Assistant Editor

The Confederation of Zimbabwe Industries released its August 2025 Inflation and Currency Developments Update, revealing a cautiously optimistic economic outlook as the country records stable monthly inflation amid ongoing currency market gaps.

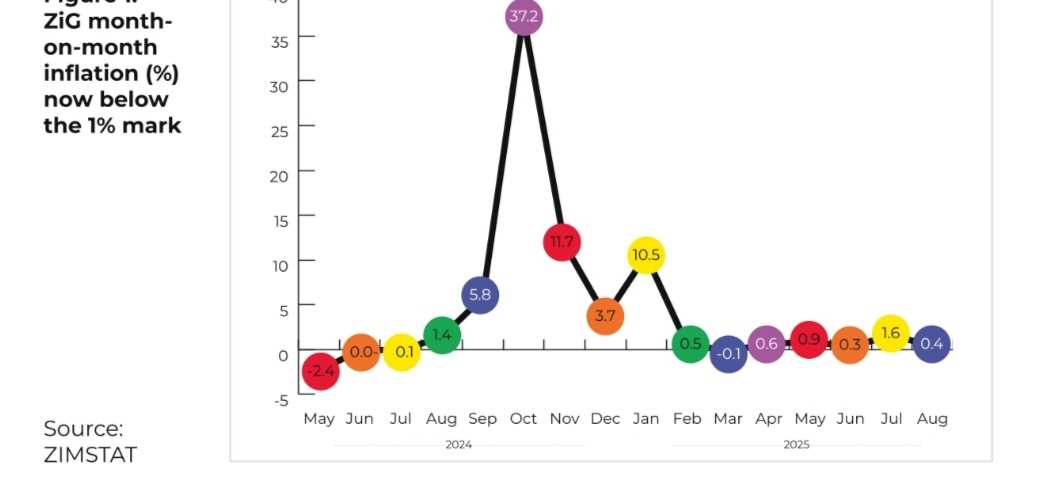

According to the report, month-on-month inflation for the Zimbabwe Gold (ZiG) currency slowed to 0.4% in August, comfortably below the 1% stability threshold.

"ZIG inflation slowed down to 0.4% in the month of August 2025 and the ZIG annual inflation has also declined, although by a small margin," the report notes, highlighting that short-term price pressures are easing.

Meanwhile, USD-denominated inflation registered 0%, down from 0.2% in July, reflecting continued stability in hard currency pricing.

CZI cautioned that while ZiG stability provides some relief, persistent divergence between official and parallel market exchange rates continues to challenge businesses.

The report indicates that the parallel market premium has held steady at 27% for two consecutive months, with the official exchange rate remaining 93.8% higher.

"The incentive to use the parallel market may persist as long as the premium remains high," the report said.

The Confederation projects that annual ZiG inflation could remain below 20% by December 2025 if month-on-month inflation continues to grow by less than 1% over the next four months.

"If ZIG month-on-month inflation continues to grow by less than 1% in the next four months to December 2025, annual inflation is projected to be less than 20%," the report notes, adding that the 2025 Midterm Monetary Policy Statement targets of maintaining annual ZiG inflation below 30% are likely to be achieved.

For businesses and consumers, the August update underscores a mixed economic environment.

While monthly inflation stability signals a measure of predictability for investment and planning, unresolved currency misalignments in the parallel market continue to pose risks to economic certainty.

The CZI report concludes that continued efforts in exchange rate management and broader anti-inflationary interventions will be critical in consolidating the gains of monetary stability and boosting market confidence across Zimbabwe’s economy.

Leave Comments