The Zimbabwe Revenue Authority has rolled out revised presumptive tax rates for commuter omnibuses, taxis, driving schools, and goods vehicles, with effect from September 1, 2024.

The changes, issued under Section 36(C) of the Taxes Act, are being enforced with the Zimbabwe National Road Administration as the collection agent.

According to ZIMRA, the revised framework seeks to ease the burden on small-scale operators while tightening compliance in sectors historically difficult to capture through conventional tax systems.

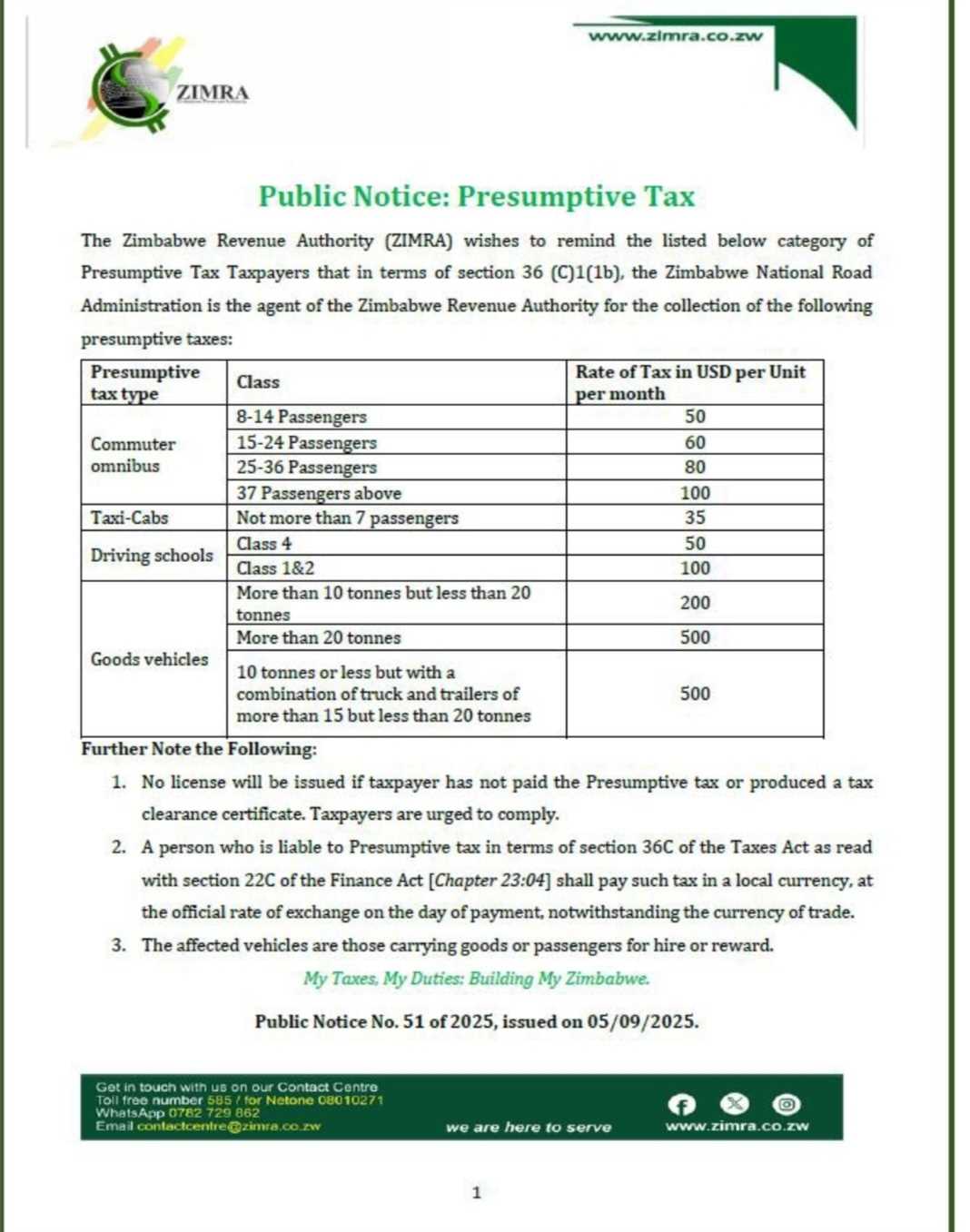

Commuter omnibuses will now pay between US$50 and US$100 per month depending on seating capacity.

Taxi cabs are pegged at US$35 per month, while driving schools and goods vehicles will also be charged at fixed rates based on seating capacity or vehicle weight.

In quarterly terms, the rates range from US$150 for non-metered taxis to US$1,500 for large commuter buses, and up to US$900 for goods vehicles weighing more than four tonnes.

ZIMRA stressed that compliance is non-negotiable. “No vehicle licence or insurance will be issued without proof of presumptive tax clearance,” the authority said in its notice.

“Operators must produce clearance from the Commissioner General of ZIMRA confirming registration and compliance before ZINARA can process licences or insurers issue cover.”

The move follows adjustments announced in the July 2024 Mid-Term Budget Review, when government slashed some presumptive taxes to align them with economic realities.

For example, tax for 18-seater kombis dropped from US$175 to US$60 per month, while hairdressers saw their obligations reduced from US$300 to just US$30.

ZIMRA said the new structure is meant to provide balance between revenue collection and sustainability for small businesses.

“By setting clear and predictable rates, we are creating a fair system that recognises operators’ economic challenges, while ensuring that everyone contributes their share of tax,” the authority noted.

Payments can be made in either US dollars or Zimbabwean dollar equivalent at the prevailing interbank rate.

Collection points include ZIMRA offices and selected tollgates, reinforcing routine checkpoints as part of the compliance drive.

“Presumptive tax is not a penalty but a simplified way of ensuring those in the informal transport sector play their part in national development,” ZIMRA said.

“We urge all operators to regularise their affairs to avoid penalties or disruptions to their business operations.”

Leave Comments