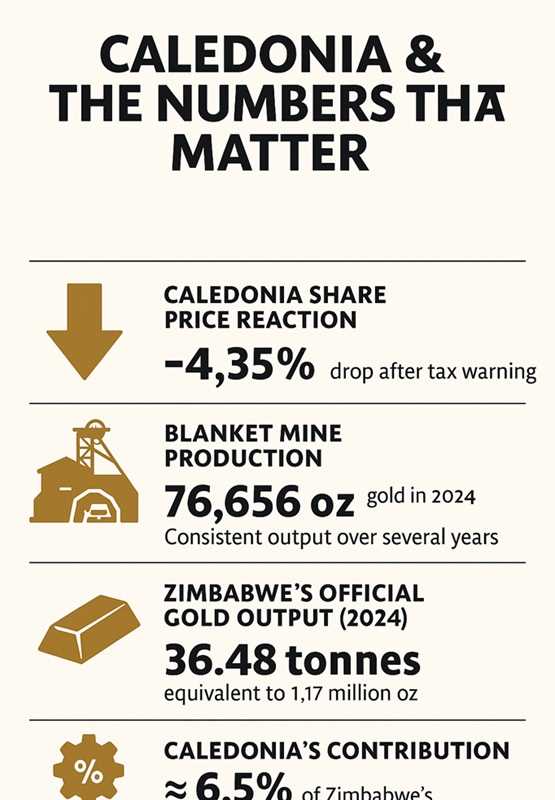

Caledonia Mining’s share price slipped more than 4% on Monday after the company warned that Zimbabwe’s proposed new tax and royalty regime could weaken profitability at its flagship Blanket Gold Mine.

The drop — one of the sharpest single-day moves for the stock this quarter — came immediately after the miner issued an update saying it was still assessing the impact of the 2026 National Budget on its operations.

Investors reacted nervously to the budget proposal to raise the gold royalty rate from 5% to 10% whenever international prices exceed US$2,500 an ounce. What unsettled the market was Caledonia’s understanding that the higher rate would apply to the full gold price, not only the portion above US$2,500.

That interpretation effectively doubles the tax burden in high-price periods, sharply squeezing margins at a time when mines rely on strong gold prices to fund expansion and underground development.

The company also highlighted another significant change: government’s plan to scrap the long-standing rule allowing mines to deduct 100% of their capital expenditure upfront for tax purposes.

Instead, companies would recover these costs gradually over the lifespan of a project. While the total tax eventually paid remains the same, the shift dramatically alters the timing — raising tax bills in the early years when mines need cash the most. For Caledonia, which is advancing the Bilboes Gold Project, this is a material concern.

Related Stories

To understand why the market reacted so strongly, it helps to examine Caledonia’s position in Zimbabwe’s gold sector. Blanket Mine produced 76,656 ounces of gold in 2024, according to official company data. Zimbabwe’s total declared gold output for the same year was 36.48 tonnes, or about 1.17 million ounces, putting Caledonia’s contribution at just under 6.5% of national output.

In a sector dominated by hundreds of small and informal producers whose volumes are harder to track, Blanket remains one of the country’s most reliable formal operations — and a consistent official foreign currency generator.

A change in fiscal conditions that threatens profits at such a stable mine sends a wider signal to the market. Investors reading Monday’s statement interpreted it as more than just a corporate note — they saw it as a sign that Zimbabwe may be shifting towards heavier extraction during boom cycles.

For mining companies that plan capital budgets years in advance, sudden changes in royalties or deductions force rapid recalculations of project viability. That makes Caledonia’s early warning important beyond the company itself.

Other major producers such as Freda Rebecca, Shamva, Dallaglio and RioZim have not yet issued public responses, but industry officials acknowledged privately on Monday that the proposals could complicate expansion plans.

Mines already struggling with power constraints, foreign currency uptake, high consumables costs and declining grades would feel the pressure first. New projects still in feasibility or financing stages may face delays, as investors demand compensating guarantees before committing capital.

Caledonia has maintained a long-standing presence in Zimbabwe and said it plans to update the market once it has a firmer reading of the proposed tax regime.

Leave Comments