Oscar J Jeke

Zim Now Reporter

Caledonia Mining Corporation Plc has delivered its strongest second quarter in history, powered by record output at its flagship Blanket Mine in Zimbabwe, higher global gold prices, and a cash injection from the sale of its 12.2MWac solar plant. The results for the quarter ended June 30, 2025, paint a picture of a gold producer that is not only benefiting from favourable market conditions but also consolidating its operational efficiency, expanding exploration, and fortifying its balance sheet.

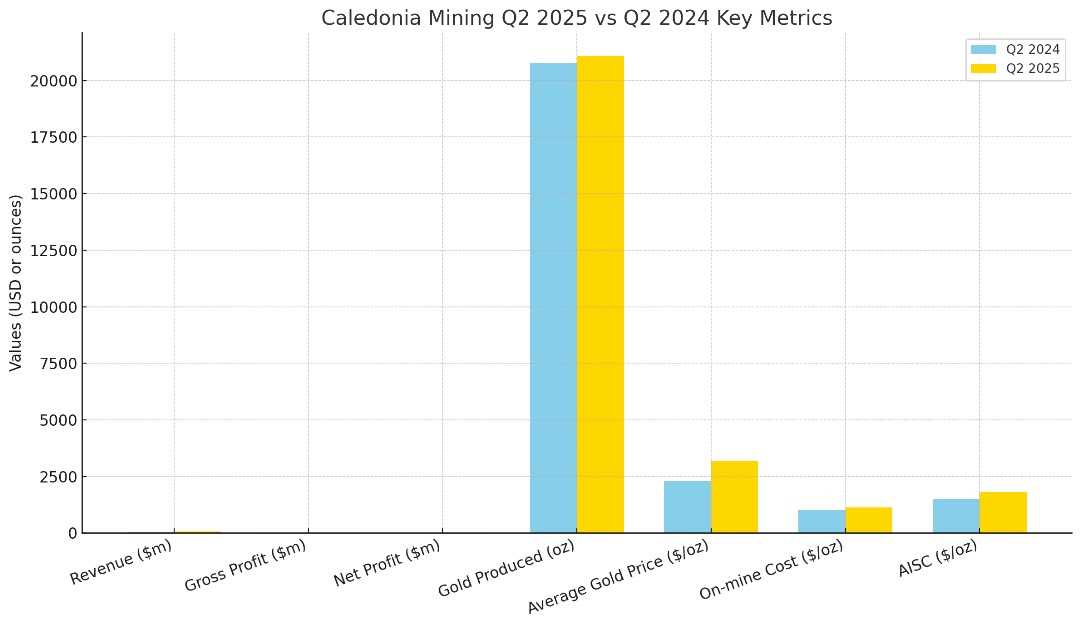

Revenue for the quarter rose 30% year-on-year to $65.3 million, compared to $50.1 million in the same period of 2024, according to the unaudited financial statements. The growth was driven primarily by a 38.5% jump in the average realised gold price to $3,186/oz, reflecting robust global bullion demand and macroeconomic conditions favouring gold as a safe-haven asset. The volume of gold sold dipped by 5.9% to 20,487 ounces due to a higher end-of-period work-in-progress inventory of 4,115 ounces compared to 1,066 ounces in Q2 2024. That unsold gold was subsequently sold in early July, suggesting Q3 revenue may also benefit from a timing boost.

Gross profit rose 48% to $33.8 million, while net profit attributable to shareholders surged 147% to $20.5 million from $8.3 million a year earlier. Adjusted earnings per share jumped to 113.9 cents from 44.6 cents. The profit leap was aided by an $8.5 million one-off gain from the April sale of Caledonia’s Zimbabwe solar subsidiary, Caledonia Mining Services (Pvt) Ltd, to CrossBoundary Energy Holdings. The sale not only injected $22.35 million in cash but also ensured long-term renewable power for Blanket Mine under an exclusive power purchase agreement. EBITDA for the quarter almost doubled, rising 94% to $39.5 million, underscoring the combined effect of strong operational performance and favourable pricing.

Blanket Mine delivered 21,070 ounces of gold, up 1.4% from Q2 2024 and marking its highest-ever second-quarter output. The gains were underpinned by improved head grades of 3.39g/t and a record plant recovery rate of 94.4%, achieved through an additional carbon-in-leach tank, better reagent dosage control, and improved process monitoring. This operational momentum prompted management to lift Blanket’s 2025 production guidance from 74,000–78,000 ounces to between 75,500 and 79,500 ounces, a signal of confidence in sustaining higher output. Exploration results at Blanket continue to be encouraging. Drilling from January 2024 to April 2025 covering 6,976 metres confirmed better-than-expected grades in the Blanket and Eroica orebodies, extended mineralisation at Lima beyond 750 metres depth, and revealed a new potential orebody with “impressive” grades and widths. Surface exploration on the Blanket lease area also returned assays of up to 32.12g/t from quartz-filled shear zones within Banded Iron Formation.

Related Stories

While revenue and profits surged, cost control emerged as a key challenge. On-mine cost per ounce rose 10.9% to $1,123 from $1,013 a year earlier, driven by higher labour costs, increased consumables expenses from plant and machinery repairs, and inflationary increases in Zimbabwe Gold (ZiG)-denominated expenses. All-in sustaining costs climbed 21.5% to $1,805/oz, reflecting not only the on-mine cost increase but also higher sustaining capital expenditure on underground development, IT upgrades, and process improvements. Management acknowledged these pressures but framed them as part of a deliberate modernisation and life-of-mine extension strategy rather than uncontrolled cost creep.

Caledonia ended the quarter with $26.2 million in net cash and fixed-term deposits, a dramatic turnaround from a net debt position of $1.4 million a year earlier. Operating cash flow jumped 47% to $28.1 million, while the solar plant sale added another $22.35 million. Some $18 million of this was placed into fixed-term deposits, signalling a conservative treasury stance while awaiting deployment into growth projects. Capital expenditure for the half year reached $17.7 million, with $10.5 million in Q2, mainly directed to Blanket’s infrastructure. Exploration spend was $3.1 million, concentrated at Bilboes and Motapa.

The feasibility study for the Bilboes sulphide project, initially due in the first half of 2025, is now incorporating additional factors that could improve project economics. Bilboes oxide mine, though on care and maintenance, produced 372 ounces in the quarter from residual heap leach operations. At Motapa, a $2.8 million drilling campaign is targeting both sulphide and oxide mineralisation. With Motapa adjacent to Bilboes, synergies could emerge if viable resources are identified.

Q2 2025 marked the last time Caledonia will publish full quarterly financials under Canadian rules. From now on, the company will report detailed financials only for half-year and annual periods, while still disclosing key quarterly production and cost data. Management says the move aligns with SEC foreign issuer rules and streamlines reporting without reducing transparency. Board changes included the retirement of long-serving director and Audit Committee chair Johan Holtzhausen, replaced by independent director Tariro Gadzikwa.

Zimbabwe’s volatile currency environment remains a risk. The Zimbabwe Gold currency weakened from 13.56:USD1 at inception in April 2024 to 26.95:USD1 by end-June 2025, contributing to a $1 million foreign exchange loss in Q2. Retention thresholds on gold receipts also shifted, with 70% now in USD and the remainder in ZiG, adding to forex exposure.

A quarterly dividend of 14 cents per share was declared on August 11, maintaining Caledonia’s policy of consistent shareholder returns even amid high reinvestment. Chief executive officer Mark Learmonth said the quarter underscored the company’s operational resilience, noting that record production and favourable gold prices have positioned the business strongly for growth.

The company’s near-term priorities are to hit the higher Blanket guidance, finalise the Bilboes feasibility study, advance Motapa exploration, and manage cost inflation without compromising on strategic investments. The Q2 2025 performance cements Caledonia’s reputation as one of Zimbabwe’s most reliable gold producers. Its production stability contrasts with the volatility often seen in regional peers, while the strong cash position gives it optionality in an uncertain macroeconomic climate. However, the rise in all-in sustaining costs to $1,805/oz warrants close monitoring, especially if gold prices soften. The deliberate classification of more capital as sustaining expenditure after the completion of the Central Shaft will keep AISC elevated unless offset by higher production volumes or efficiency gains.

Leave Comments