A closer look at the numbers shows a different story

ZimNow Analysis Desk

When Econet released its latest half year figures showing data traffic that had doubled and voice usage that had climbed by more than thirty percent, a familiar argument resurfaced almost immediately.

Had Starlink, with all its hype and global glow, failed to disrupt Zimbabwe’s dominant operator? If Econet is breaking usage records at the very moment a disruptive satellite entrant arrives, does that mean the so-called dethroning never happened?

It is an easy framing, yet when you look more closely at what is happening in Zimbabwe’s digital ecosystem, the story is far more layered. Econet’s surge is real and significant, but Starlink’s growth is equally real, although concentrated in a very different slice of the market.

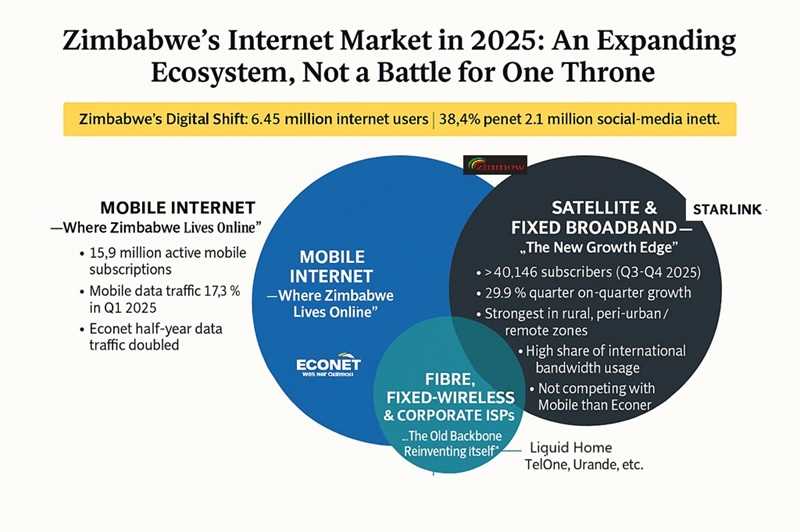

The numbers show that Zimbabweans are not choosing one or the other. Zimbabwe’s internet market is expanding in multiple directions at once, opening space for providers that do not even compete directly.

The country now has about 6,45 million internet users, which translates to roughly 38 percent penetration. In any other context this would look modest, but when you overlay the fact that active mobile subscriptions stand at around 15,9 million, meaning well over one SIM card per person on average, it becomes clear where Zimbabwe lives online.

Mobile internet is the default gateway into the digital world for most citizens and that is the terrain Econet knows and dominates. Mobile internet traffic jumped by over seventeen percent in the first quarter of 2025 alone and the trend has been consistently upward since last year. In that environment Econet’s performance tells a story of a population using more data and relying on mobile networks for daily digital life.

Starlink’s numbers point in a different direction. Its subscriber base grew to more than 40 000 users between the third and fourth quarter of 2025, which works out to just under 30 percent quarter on quarter growth. By global standards this is a modest figure, but by Zimbabwean fixed internet standards it is a serious surge.

Related Stories

Many of these users are rural, peri urban or remote clients who previously had no reliable option at all. For others, especially businesses, farms and high bandwidth households, the appeal is stability and speed rather than mobility.

Starlink has also become a significant channel for Zimbabwe’s international bandwidth, which means that even when most people are not subscribers, the network still carries a meaningful share of the country’s digital burden.

Add to this the old but steadily adapting fixed internet players who sit in yet another niche. Liquid Home, TelOne, Utande and other fibre and wireless operators serve homes and businesses that want predictable broadband rather than mobile convenience.

The sector has been improving quietly, with median fixed download speeds rising by more than twenty seven percent over the past year. When you line up these operators together with Starlink and the mobile giants, the picture resembles an ecosystem rather than a battlefield.

The broader digitisation trend strengthens this interpretation. Zimbabwe had about 2,1 million active social media identities in early 2025, a sign that digital behaviour is deepening, not just widening. More people are spending more time online which means the market is not static.

It is expanding fast enough for multiple winners to emerge, each supplying a different layer of demand. Mobile networks carry the daily grind of communication, streaming and messaging. Satellite providers carry the remote, the neglected and the bandwidth hungry. Fibre and wireless providers serve homes, offices and specialised users that need stability.

So, has Starlink failed to dethrone Econet? The answer depends on what throne you imagine. If the throne is mobile internet, the heartland of everyday digital life, then Econet has never surrendered it and was never likely to.

If the throne is reliable broadband for places that have waited decades for connectivity, then Starlink sits comfortably in that seat. Markets do not dethrone incumbents by magic. They evolve, bend and sometimes split into new sub-markets as new technologies arrive.

In Zimbabwe the data shows a nation moving deeper into digital life. Econet is rising because more people are using more data. Starlink is rising because a new segment finally has options. The fixed operators are rising because households and businesses are slowly upgrading their expectations.

No single provider is losing ground dramatically. The country is simply shifting into a higher gear and everyone who offers value in their niche is moving with it. The real story is not a dethroning. It is a widening of the digital table.

Leave Comments