Tigere Property Fund has crossed the US$101 million capitalisation mark, underscoring the rapid scale-up of its property portfolio and strengthening its position among Zimbabwe’s leading listed real estate investment trusts.

The milestone follows the successful integration of the Greenfields Retail Complex and the Zimre Park Drive-Thru asset in 2025, transactions that have significantly expanded the fund’s asset base while enhancing its income-generating capacity.

Greenfields, one of Tigere’s most recent additions, has emerged as a key growth driver, outperforming initial forecasts.

The retail complex hosts major tenants including Smokehouse, Hungry Lion, Rocomamas, Spar, Liquor Supplies and Rollers, whose strong trading performance has boosted rental income and supported higher distributable earnings.

Related Stories

The enlarged portfolio has translated into improved returns for investors. Tigere expects distributable earnings for 2025 to exceed US$2.3 million, with forecast payouts of between US¢0.1900 and US¢0.1980 per unit. This represents a 17 percent to 22 percent increase on distributions made in 2024.

Building on the stronger capital base, the fund has set an ambitious target of delivering at least US$1 million in dividends per quarter in 2026, reflecting management’s confidence in tenant stability, occupancy levels and rental growth across its assets.

Beyond scale, Tigere’s US$101 million capitalisation also reflects a broader diversification strategy. The fund is expanding its geographic footprint and foreign currency exposure through a pipeline of retail developments across multiple urban centres, reducing reliance on Harare while positioning for long-term growth.

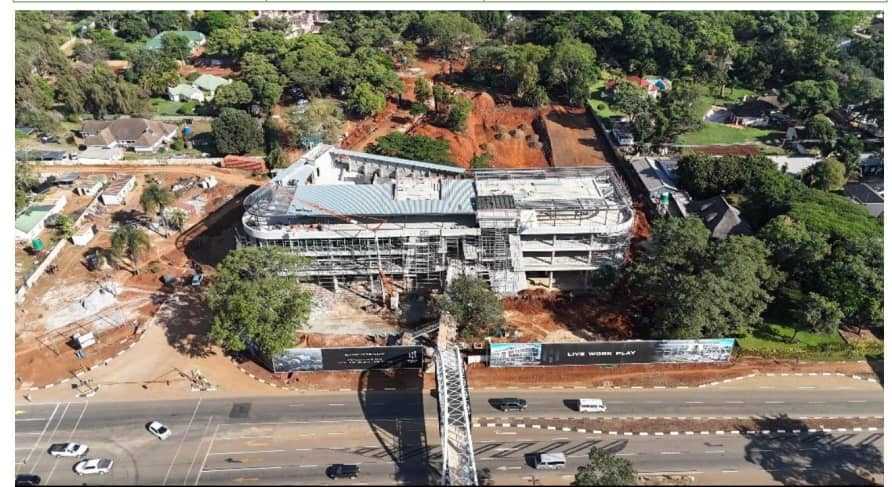

Several projects are scheduled for delivery between 2026 and 2027, including Design Quarter, Cardinals Corner, Kadoma Retail Phase 1 and Gweru Phase 1 in 2026. Ruwa Zimre Park Phase 2 is planned for completion in 2027, while a Bulawayo retail development is also expected to come on stream in 2026.

The expansion drive follows unitholder approval for acquisitions valued at approximately US$25.1 million, including Greenfields Retail Centre and Zimre Park Drive-Thru Phase 1, deals that have materially lifted Tigere’s net asset value and reinforced its growth trajectory.

With a growing asset base, rising earnings and a development pipeline aligned to consumer demand, Tigere’s US$101 million capitalisation signals a new phase in the fund’s evolution as it positions for sustained income generation and investor returns.

Leave Comments