Willdale Limited recorded a difficult financial year ended September 30, 2025 after revenue fell sharply and the brick manufacturer slipped into an operating loss, weighed down by working-capital constraints, lower production volumes and rising costs.

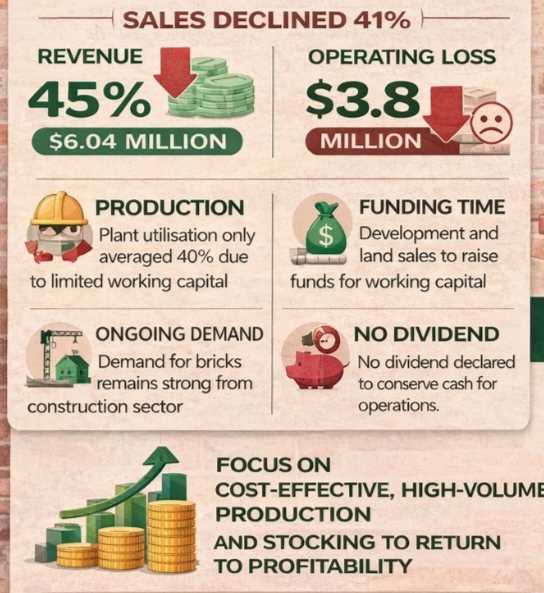

According to the company’s audited abridged financial statements, revenue declined by 45 percent to US$6.04 million from US$11.08 million in the prior year, largely due to a 41 percent reduction in sales volumes. The downturn pushed the company into an operating loss of US$3.8 million, compared to a loss of US$1.8 million in 2024.

In his statement accompanying the results, Willdale chairman B.K. Mataruka said the year under review was characterised by a relatively stable macroeconomic environment, but operational challenges undermined performance. “The year under review was marked by a stable macro-economic environment, supported by a steady exchange rate and moderate inflation,” he said.

“However, operations were constrained by limited working capital, which negatively affected margins and overall profitability.”

Production was one of the hardest-hit areas, with plant utilisation averaging just 40 percent during the year, down from 62 percent previously. The company attributed the decline to disruptions in raw material supplies and critical maintenance spares, both linked to funding shortages.

“Plant utilisation averaged 40 percent due to working-capital constraints that disrupted the supply of raw materials and critical maintenance spares, impacting throughput and operational efficiency,” Mataruka said.

Despite the weak performance, Willdale said demand for bricks remained strong, driven by ongoing construction of residential clusters, industrial warehouses, shopping malls and educational facilities.

Management expects volumes to recover once production stabilises. “Volumes are expected to rise significantly once production stabilises with adequate working-capital support,” the chairman noted.

Related Stories

As part of efforts to improve liquidity, development work on Phase 1 of the Dale land has commenced, with the site being prepared for conversion into an industrial park. Proceeds from the sale of stands are expected to provide critical funding for both working capital and capital expenditure.

“Proceeds from stand sales are expected to generate additional revenue in the coming year and provide essential funding for working capital and capital expenditure,” Mataruka said.

The company is also considering strategic investments to improve efficiency, including the planned acquisition of a more efficient common-brick plant. Management believes this will strengthen competitiveness and improve margins once funding is secured.

On governance and sustainability, Willdale reported that it remains committed to environmental stewardship and workplace safety, maintaining its ISO-certified integrated management system covering quality, environmental management and occupational health and safety.

The board was also strengthened during the year with the appointment of M.S. Manhando and M.T. Mutezo as directors.

Looking ahead, the board remains cautiously optimistic, citing improved cash-flow prospects once land sales progress and production normalises. “The removal of illegal settlers and the commencement of site-servicing works on the Dale land are expected to enhance cash-flow generation and provide critical funding for working capital and capital expenditure,” the chairman said.

However, no dividend was declared for the year, as the company opted to conserve cash. “The directors resolved not to declare a dividend for the year ended 30 September 2025, given the operating loss incurred and the need to preserve cash for working capital,” Mataruka said.

Despite the setbacks, the board maintained that Willdale remains a going concern and is positioning itself for a return to profitability.

“To remain competitive, the Company will focus on efficient, cost-effective, high-volume production and adapt to a market environment that increasingly requires stocking,” Mataruka said, adding that the company expects the measures underway to support improved performance in the coming financial year.

Leave Comments