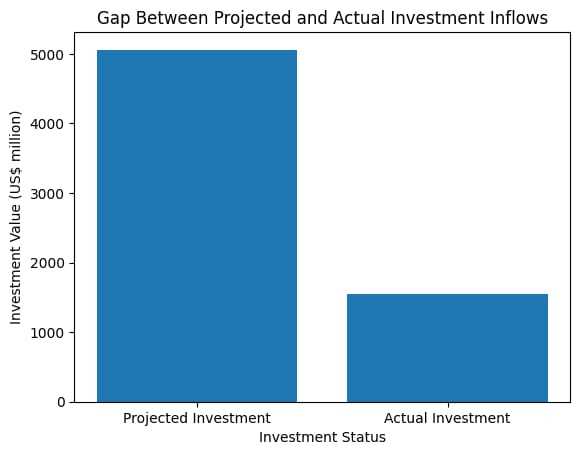

Zimbabwe has realised just 31% of projected investment from monitored projects since 2022, with actual inflows amounting to US$1.55 billion against projected commitments of US$5.06 billion, according to the Zimbabwe Investment and Development Agency Q4 2025 performance data.

Out of 2,444 investment projects licensed between January 2022 and December 2025, only 471 projects—representing 19%—have been monitored, highlighting significant implementation and oversight gaps within the investment pipeline.

ZIDA said the monitored projects carried projected investment values of US$5.06 billion, while total licensed projections stood at US$39.96 billion. This means actual inflows realised so far represent just 4% of all licensed investment since 2022.

Related Stories

The agency flagged concentration risk within the pipeline, noting that “a single project, Magcor Consortium Group of Companies Zimbabwe (Pvt) Ltd, accounts for 15% (US$6 billion) of the total US$39.958 billion projected investment,” despite having “not made progress on financing since the previous reporting period”.

Foreign exchange loan financing recorded the weakest performance, with only US$392 million realised out of US$2.18 billion projected—an 18% realisation rate—while equity injections reached US$365 million against projections of US$1.31 billion.

ZIDA acknowledged the structural challenge, stating that “the investment inflows data show a significant gap between projections and actual inflows across all categories,” citing financing constraints, regulatory delays and macroeconomic pressures as contributing factors.

Despite increased licensing activity in 2025, the data points to a persistent disconnect between project approvals and execution, raising questions around project readiness, financing closure and post-licensing facilitation capacity as Zimbabwe advances under the National Development Strategy 2.

Leave Comments