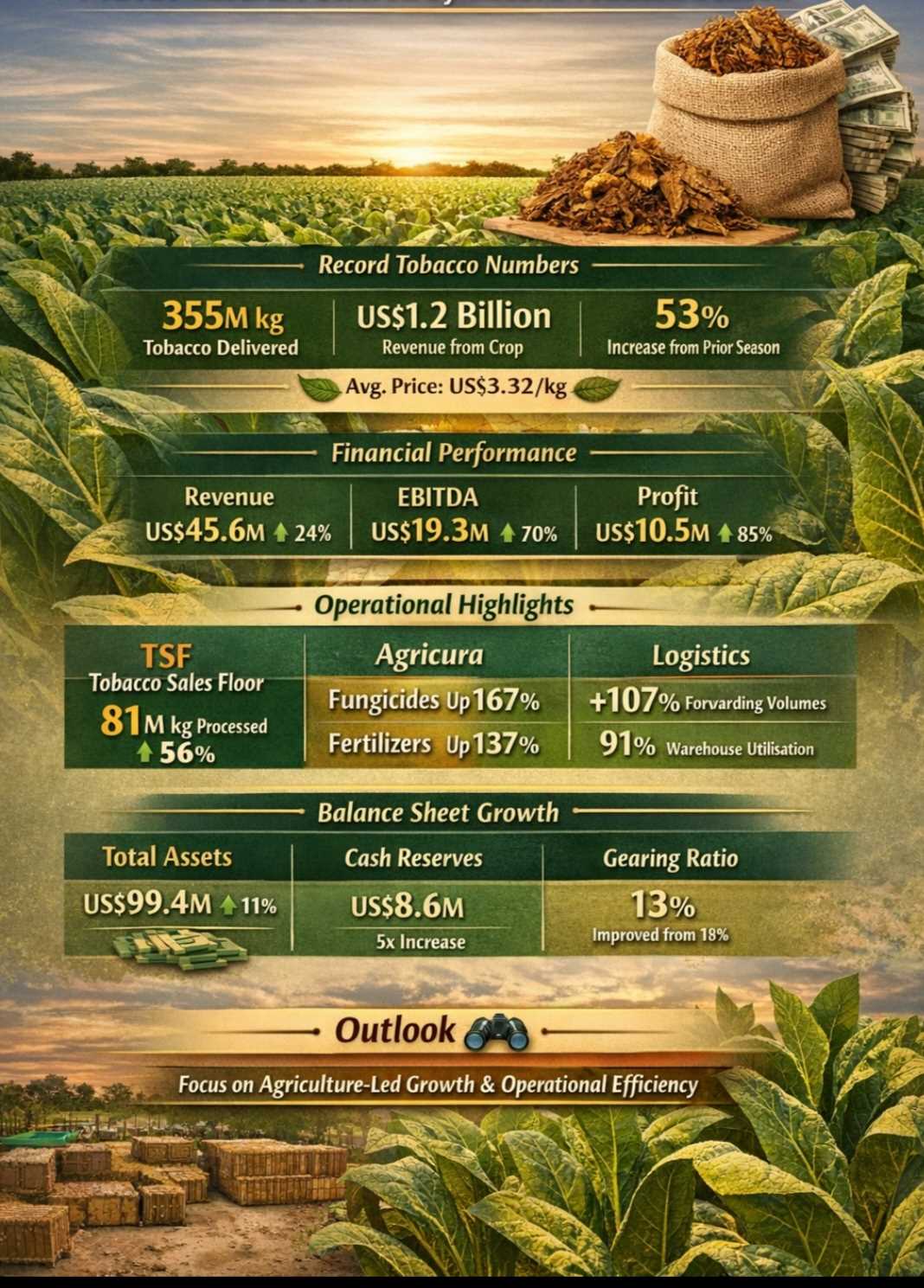

TSL Limited’s strong performance for the year ended 31 October 2025 was anchored by a record tobacco season, with national deliveries reaching 355 million kilogrammes and generating approximately US$1.2 billion in value.

The delivery volumes represented a 53 percent increase from the previous season’s 232 million kilogrammes, underscoring the central role of tobacco in driving agricultural activity and supporting growth across TSL’s integrated value chain.

The average selling price remained firm at US$3.32 per kilogramme, despite softening marginally by three percent from the prior season.

Presenting the Group’s abridged consolidated audited financial results, the TSL chairman said the improved agricultural performance was a key driver of the group’s recovery.

“The operating environment during the year under review was more favourable than in the prior reporting period, mainly underpinned by a recovery in the agricultural sector following the El Niño-induced drought experienced in the previous year,” he said.

Tobacco Sales Floor (Private) Limited (TSF), a key subsidiary, handled 81 million kilogrammes during the year, up from 52 million kilogrammes previously, representing growth of 56 percent year on year. The increased throughput was recorded across TSF’s sales floors in Harare, Mvurwi, Karoi and Marondera.

“The increase in tobacco volumes was supported by a successful 2024/25 summer cropping season, increased grower participation and strong merchant engagement across both auction and contract platforms,” the chairman said.

TSF’s decentralisation strategy and the acquisition of new business further supported volumes, while ongoing automation across sales floors resulted in cost savings of approximately 10 percent during the year.

Related Stories

Against this backdrop, revenue from continuing operations rose 24 percent to US$45.6 million, driven by improved volumes across all business units. Earnings before interest, tax, depreciation and amortisation (EBITDA) increased 70 percent to US$19.3 million, while profit for the year surged 85 percent to US$10.5 million.

The Group said profitability gains were supported by higher revenue, cost optimisation initiatives, fair value gains on investment property and gains from the disposal of selected properties and equipment.

TSL’s balance sheet also strengthened, with total assets increasing 11 percent to US$99.4 million. Shareholders’ equity rose to US$68.4 million, while the gearing ratio improved from 18 percent to 13 percent. Operating cash flows remained positive, enabling cash reserves to rise fivefold to US$8.6 million.

Within agricultural operations, Propak Hessian (Private) Limited delivered a solid performance, benefiting from the expanded tobacco crop and sustained demand for its locally coated paper products. Hessian hire volumes increased by 26 percent, although tobacco paper volumes declined by six percent, largely due to reduced exports during the period.

Agricultural trading subsidiary Agricura (Private) Limited recorded growth across most product lines despite delayed rains and competition from the informal sector. Fungicide volumes rose sharply by 167 percent following the introduction of four new products, while fertiliser volumes increased by 137 percent, albeit at lower margins.

Volumes in animal health remedies increased 220 percent, driven by the commissioning of an animal health manufacturing plant in November 2024. However, pressure was recorded in generic products, with insecticide and herbicide volumes declining by 34 percent and 35 percent respectively.

Agricura responded by rationalising branches and staff, adjusting its product mix and reducing debt levels.

The group’s end-to-end logistics cluster also benefited from the record tobacco season. Forwarding volumes more than doubled, rising 107 percent from the prior year, driven largely by fertiliser-related clearances. General warehouse utilisation increased to 91 percent, while forklift hours rose 11 percent, reflecting higher FMCG and tobacco throughput.

Green tobacco bale satellite handling volumes were 52 percent ahead of the prior year, although port full-lift volumes declined due to reduced rail movements and lower container flows.

Leave Comments