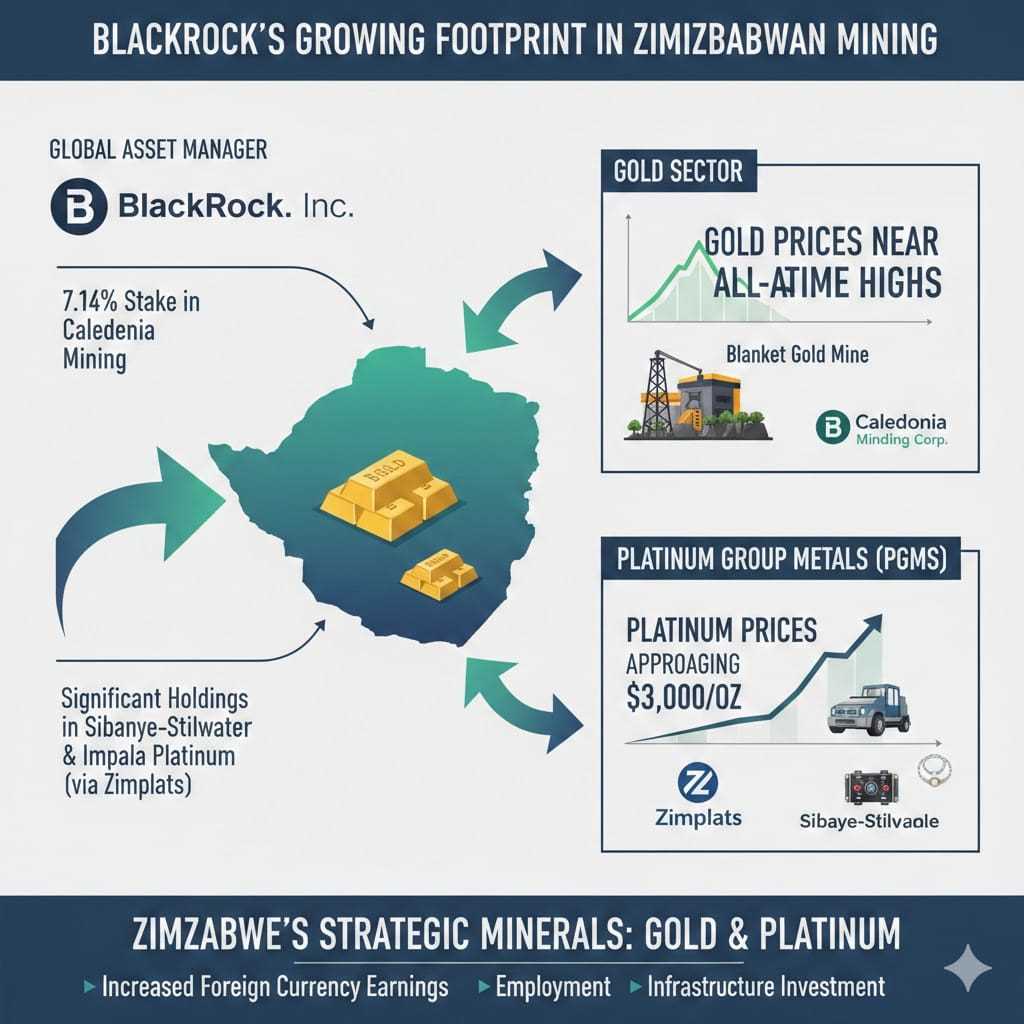

Caledonia Mining Corporation Plc has confirmed that BlackRock, Inc. has crossed a UK regulatory disclosure threshold following a change in its shareholding in the Zimbabwe-focused gold producer, underscoring the global asset manager’s growing footprint across the country’s mining sector.

Caledonia received formal notification from BlackRock on February 6, 2026, that the asset manager had crossed a relevant threshold on February 5, 2026, as defined by the AIM Rules for Companies.

According to the TR-1 filing, BlackRock now holds 7.14% of the voting rights in Caledonia, equivalent to 1,379,505 voting rights. The position comprises 5.57% in direct voting rights attached to shares and 1.57% held through financial instruments.

The direct holding amounts to 1,076,419 voting rights, representing 5.57% of the company’s issued share capital. In addition, BlackRock holds 172,513 voting rights (0.89%) through securities lending arrangements and 130,573 voting rights (0.67%) via contracts for difference (CFDs), which are cash-settled instruments. The filing states that the notification was triggered by an acquisition or disposal of voting rights.

The latest disclosure follows earlier regulatory updates indicating that BlackRock had previously reported a higher combined position of 7.45%, suggesting a subsequent adjustment in its exposure while remaining above the 5% reporting threshold.

Caledonia, a Jersey-registered company listed on the NYSE American, London’s AIM market and the Victoria Falls Stock Exchange (VFEX), operates the Blanket Gold Mine, Zimbabwe’s largest producing gold asset. With a market capitalisation of about US$609.5 million and a track record of dividend payments, the company has positioned itself as a cash-generative mid-tier producer benefiting from elevated gold prices.

Related Stories

BlackRock’s move comes amid renewed investor interest in Zimbabwe’s gold and platinum assets, driven by strengthening commodity fundamentals. Gold prices remain near historic highs, supporting robust margins for producers such as Caledonia despite cost pressures in the sector.

The asset manager’s Zimbabwe exposure extends beyond gold. In recent weeks, BlackRock has also disclosed stakes exceeding the 5% reporting threshold in Sibanye-Stillwater and Impala Platinum, both major platinum group metals (PGMs) producers with significant operations in Zimbabwe.

Impala Platinum owns Zimplats, Zimbabwe’s largest platinum producer and one of the country’s biggest foreign investors, while Sibanye-Stillwater has diversified platinum group metals and gold operations across Southern Africa and the United States. Through these holdings, BlackRock now has influential positions across Zimbabwe’s two most strategic mineral value chains — gold and platinum.

The timing of the increased institutional exposure coincides with a sharp recovery in platinum group metals prices. Platinum prices have risen significantly year-on-year amid supply deficits and renewed demand from internal combustion engine markets, while palladium has also rebounded, improving profitability prospects for producers.

The rebound follows a severe downturn in 2024, when weak prices and concerns over electric vehicle adoption led to widespread restructuring across the platinum sector, including thousands of job losses. Recent earnings reports, however, indicate improving financial performance, with some producers reporting stronger earnings and resuming dividend payments.

For Zimbabwe, where gold and platinum are among the largest sources of foreign currency earnings, employment and infrastructure investment, renewed interest from a global institutional investor of BlackRock’s scale signals strengthening investor confidence in the country’s mining sector.

BlackRock, headquartered in Wilmington, Delaware, is the world’s largest asset manager. Its stake adjustment in Caledonia was disclosed in line with UK regulatory requirements governing significant shareholdings in AIM-listed companies.

Leave Comments