Nyashadzashe Ndoro

The clean energy transition has led to a surge in demand for critical minerals, presenting opportunities for mineral-rich developing countries like Zimbabwe and South Africa to attract foreign investment and boost economic growth.

However, the United States Inflation Reduction Act is diverting investment away from these countries, according to a recent analysis done by by Arlan Brucal, an Economist in the Investment Climate Unit of the Finance, Competitiveness and Innovation Global Practice of the World Bank and Lucio Castro is a Senior Economist in the Global Investment Climate Unit of the World Bank Group's Finance, Competitiveness, and Innovation Global Practice.

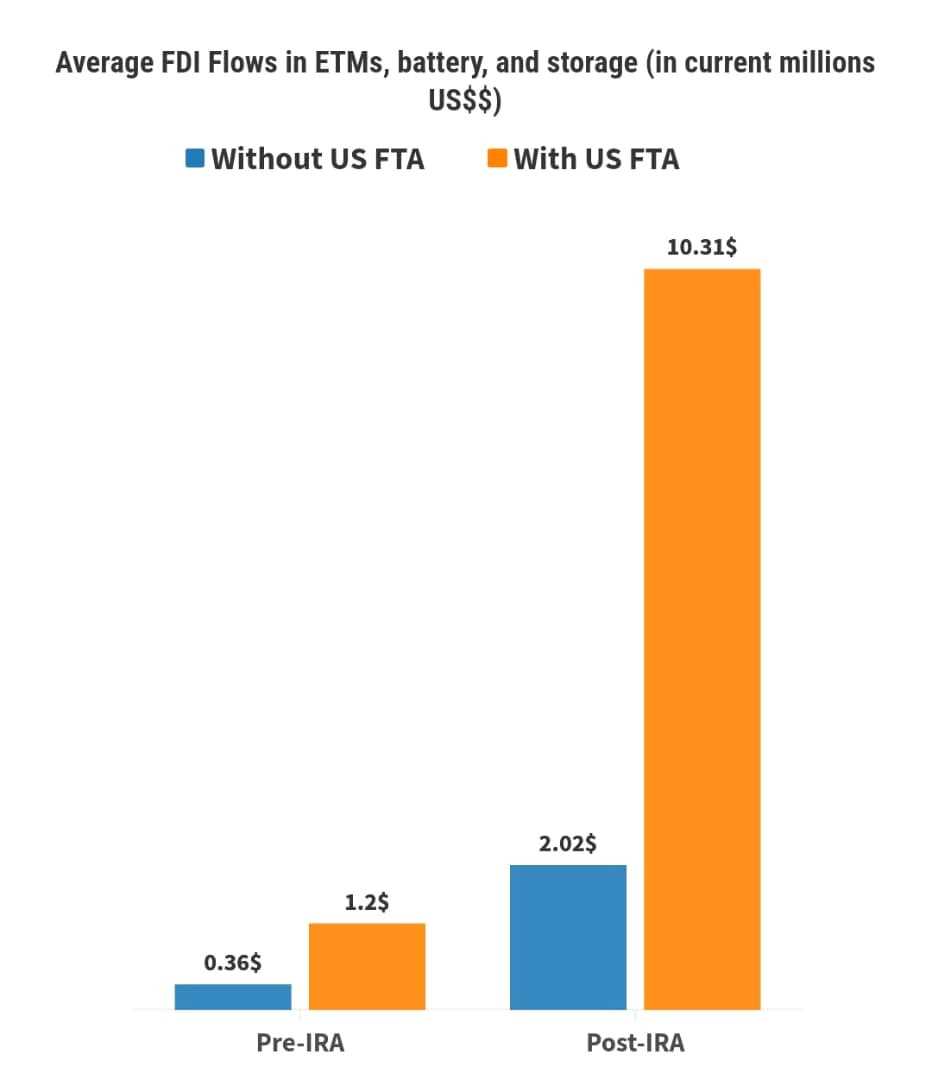

The IRA provides tax incentives for clean energy vehicle manufacturers using minerals sourced from countries with a free trade agreement with the US. As a result, countries with a US FTA have seen a ten-fold increase in greenfield foreign direct investment inflows into energy transition mineral value chains, compared to a five-fold increase in non-FTA countries.

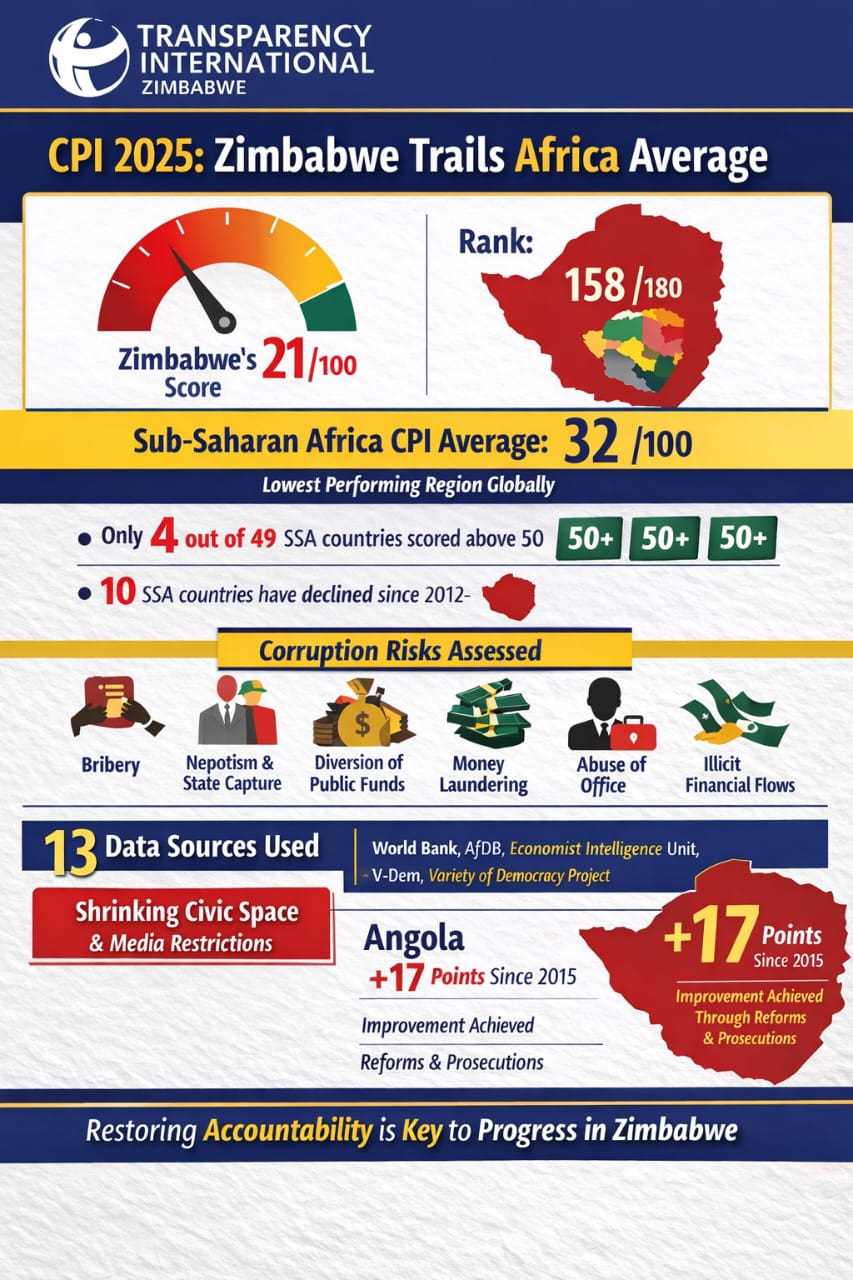

Zimbabwe and South Africa, which account for over 90% of platinum group metals, are excluded from the IRA's benefits due to lack of preferential US market access through FTAs.

Other developing countries with significant critical mineral reserves, such as the Democratic Republic of Congo, Zambia, Tanzania, Mozambique, and Madagascar, are also missing out on investment opportunities.

Related Stories

"Developing countries, including some of the poorest economies, have significant critical mineral reserves but lack preferential US market access through free trade agreements, excluding them from the IRA's benefits. For instance, the DRC holds over 40% of global cobalt reserves. Zambia and the DRC are major copper suppliers.

"Tanzania, Mozambique, and Madagascar have substantial graphite resources, while South Africa and Zimbabwe account for over 90% of platinum group metals. Botswana and Namibia share the promising Kalahari Copper Belt.

"These findings underscore the powerful effect that policies in major economies can have on steering investment and trade flows. While the IRA aims to incentivise supply chain resilience, it also risks diverting investment away from the mineral-rich developing countries that could be vital suppliers in the energy transition," reads part of the analysis.

The IRA has boosted US imports of green technology products from its FTA partners, such as Mexico, Canada, and South Korea. However, it has also led to China increasing its share of total FDI into US FTA countries from 4% to 31%, likely to avoid IRA restrictions on Chinese-affiliated suppliers.

"These findings underscore the powerful effect that policies in major economies can have on steering investment and trade flows. While the IRA aims to incentivise supply chain resilience, it also risks diverting investment away from the mineral-rich developing countries that could be vital suppliers in the energy transition," reads the article.

The analysis establishes that supporting the economic transformation of resource-rich developing countries and facilitating their participation in ETM supply chains will be crucial for diversifying global supply, enhancing resilience, and promoting inclusive and sustainable development.

It also notes that the G7 can play an important role by broadening market access, aligning standards, mobilising finance, and providing technical assistance to help developing countries convert their mineral wealth into shared prosperity.

Leave Comments