Patricia Mashiri

Zim Now Reporter

The government is set to scrap the 15% value-added tax on meat products, including fish, to increase competitiveness against imported goods. This tax, introduced earlier this year, has made it challenging for local fish producers as consumers have turned to cheaper imports.

Speaking at the fisheries and aquaculture value chain indaba, Permanent Secretary in the Ministry of Lands, Agriculture, Fisheries, Water, and Rural Development, Professor Obert Jiri, mentioned that the Fisheries Bill would soon be debated to its finality.

He acknowledged the delay, attributing it to the recent SADC summit and Parliament's adjournment. Now that Parliament is in session, the Bill is expected to progress.

Professor Jiri specified that the VAT removal will apply to meat and fish products, but not to kapenta.

“We know our stakeholders in the Fisheries sector are complaining, and we want to apologise for the delay. However, if you look closely you will see that we had a SADC summit recently. Parliament adjourned preventing the Fisheries Bill from being debated.

“Now that the Parliament is in session, we should see the Bill debated to its finality. So, the removal of VAT on meat and fish products will be done soon,” he said.

However, he highlighted that the tax removal will be on meat fish products excluding the Kapenta.

Related Stories

“With the removal of VAT on meat and other fish products we should see a change. Some of us are not fish expects and may confuse kapenta with the bream and so on. Please forgive us but we always listen to you,” he added.

Currently, VAT has only been removed on live products, which has exacerbated competition issues for local fish producers against imports from Zambia and Namibia.

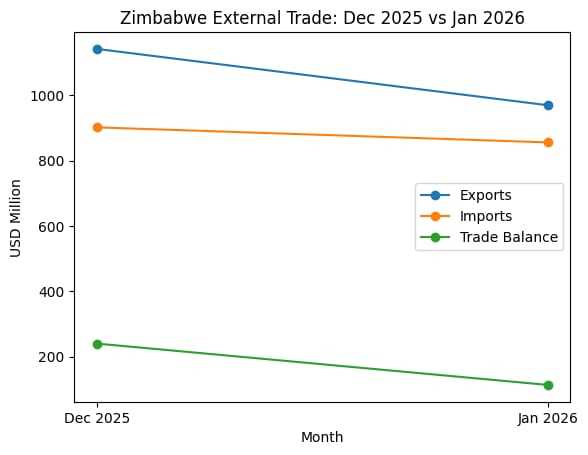

BUY Zimbabwe chairperson Munyaradzi Hwengere welcomed the tax removal, highlighting that imported fish is significantly cheaper, which has led to a substantial trade imbalance.

“Fish from Zambia and Namibia has cheaper prices compared to the ones we sell in the country. The country consumes 60 000 metric tons and we are only capable of producing 15 000 metric tons, 45 000 metric tons has been imported meaning out of every four fish we have been contributing one.

“If the tax is removed, we believe we will move in the right direction. Remember we used to export fish to other countries but it’s now vice versa. In Zambia, an average cost of fish per kilogram is US$2.80 and in Zimbabwe minimum cost is US$3.40 so, a rational consumer will go to a cheaper product regardless of where the product is coming from,” Hwengere said.

He highlighted that a lot of fish products that are coming in as smuggled which is harmful.

Private players have criticised policy gaps and high production costs as major barriers to competitiveness in the local fish market.

Leave Comments