Audrey Galawu

Assistant Editor

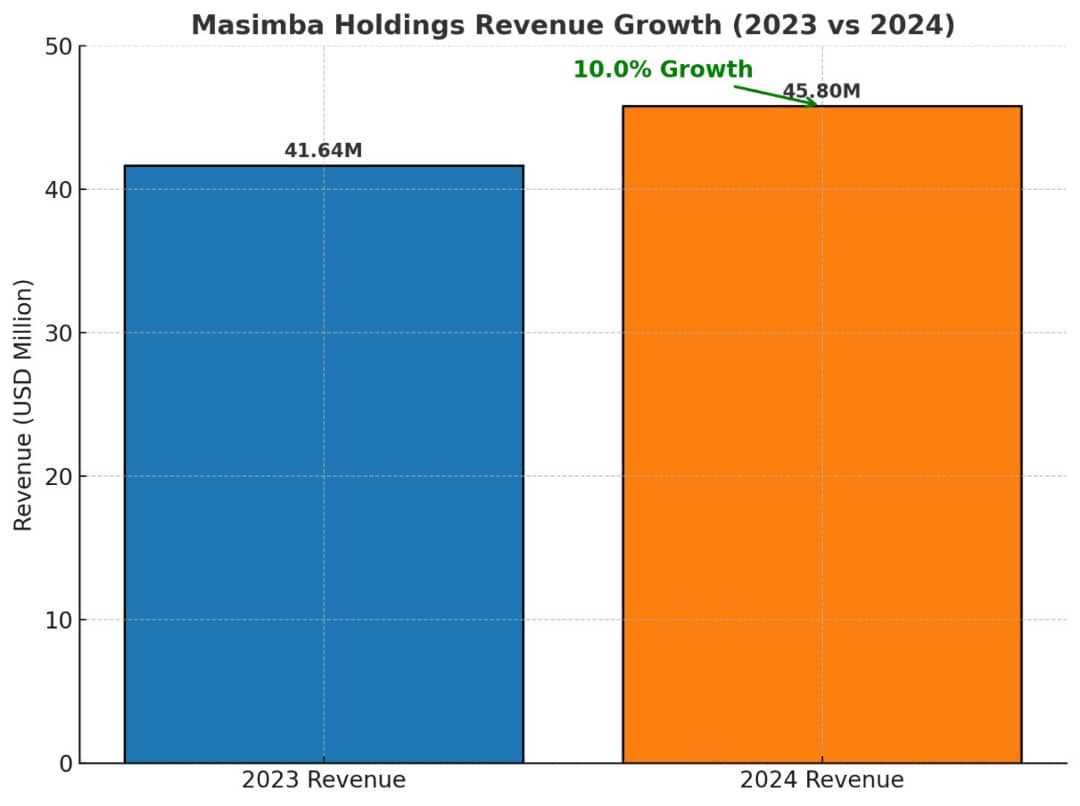

Masimba Holdings has reported a 10% revenue growth for the nine months ending September 2024, closing at US$45.8 million. This performance comes despite the significant challenges posed by inflationary pressures and a turbulent currency market.

The company’s solid revenue growth was largely attributed to a firm order book in key segments, particularly in Mining and Housing Infrastructure.

These sectors showed sustained demand, contributing positively to the company's top line. However, the broader market conditions, notably liquidity constraints, subdued the potential for even stronger performance.

Related Stories

One of the most significant developments during the period was the introduction of the Zimbabwe Gold currency, which initially helped ease inflationary pressures. Unfortunately, this relief was short-lived. The currency experienced a sharp devaluation of 42% by the end of September, which put substantial pressure on exchange rates, further exacerbating inflationary concerns.

Despite these macroeconomic challenges, Masimba Holdings has managed to maintain profitability, driven by improved profit margins. This was made possible through the successful implementation of cost containment strategies and enhanced operational efficiencies. The company’s ability to weather the financial storm, while still improving its profit constraints, speaks to its agile management and commitment to navigating the country's challenging economic landscape.

On the liquidity front, Masimba Holdings reported a strengthening of its position, attributed to efficient working capital management. The company’s borrowings at the close of Q3 stood at US$1 188,434, with the bulk denominated in US dollars. While the business faces ongoing liquidity constraints, the management's focus on effective cash flow and resource management has helped mitigate potential risks.

Safety and quality management remain a top priority for the company, with Masimba Holdings achieving zero accidents in the quarter, a testament to its robust commitment to employee safety and operational integrity.

Looking ahead, the company remains cautious about the macroeconomic environment. With contractionary fiscal policies and ongoing pricing distortions driven by exchange rate discrepancies, the business landscape is expected to stay tight.

However, Masimba Holdings is optimistic that securing sustainable financing for key infrastructure projects across the nation will contribute to continued growth and positive socio-economic outcomes. The group is forecasting sustained profitability for the remainder of the financial year, closing 2024 on a positive note despite the turbulent operating environment.

Leave Comments