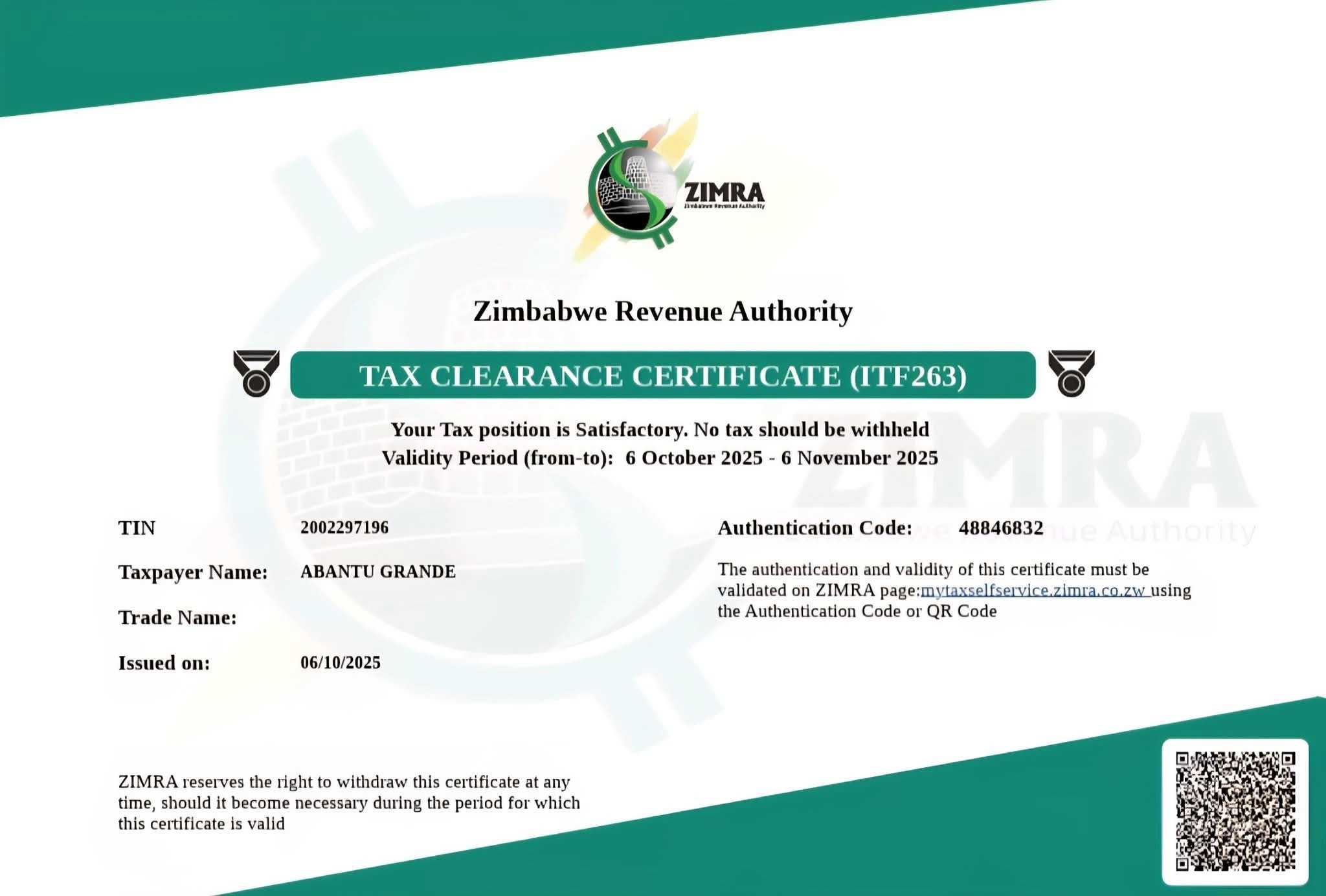

The Zimbabwe Revenue Authority has issued a public notice reminding taxpayers about the conditions under which Tax Clearance Certificates (ITF263) will be granted.

In a statement published this week, the authority emphasized that certificates will only be issued to compliant taxpayers or those who have made satisfactory arrangements to meet tax obligations — including the submission of returns, payment of taxes due, and adherence to fiscalisation requirements.

ZIMRA noted that, in accordance with Section 34C of the Revenue Authority Act [Chapter 23:11], taxpayers may only request a Tax Clearance Certificate once they are “up to date” with their obligations. Compliance, the authority said, includes submitting all due tax returns and settling any outstanding taxes.

Related Stories

“Taxpayers registered for VAT must comply with the requirements of fiscalisation and the Fiscalisation Data Management System (FDMS),” ZIMRA said in its statement.

The authority further urged businesses to make arrangements to submit outstanding returns and payments and to provide all information required by law, such as details of appointed public officers.

ZIMRA also warned that, with immediate effect, Tax Clearance Certificates will no longer be issued to taxpayers who are not trading or who fail to use registered fiscal devices when recording all sales transactions, if they are registered for VAT.

The tax authority appealed to businesses that are operating but submitting NIL returns or failing to comply with fiscalisation requirements to regularize their tax affairs.

“Taxpayers are strongly encouraged to immediately comply and voluntarily disclose their actual business transactions to avoid penalties and interest, and to become eligible for a valid Tax Clearance Certificate (ITF263),” ZIMRA said.

Leave Comments