Parliament became a battleground of sharp political and economic disagreements on December 9, 2025, as lawmakers fiercely debated the wide-ranging new and revised tax measures contained in the Finance Bill, which underpins the 2026 National Budget.

The heated exchanges highlighted the delicate balancing act facing legislators: supporting Government’s push to raise revenue and stabilise the fiscus, while avoiding a tax burden that could further strain already vulnerable households and businesses.

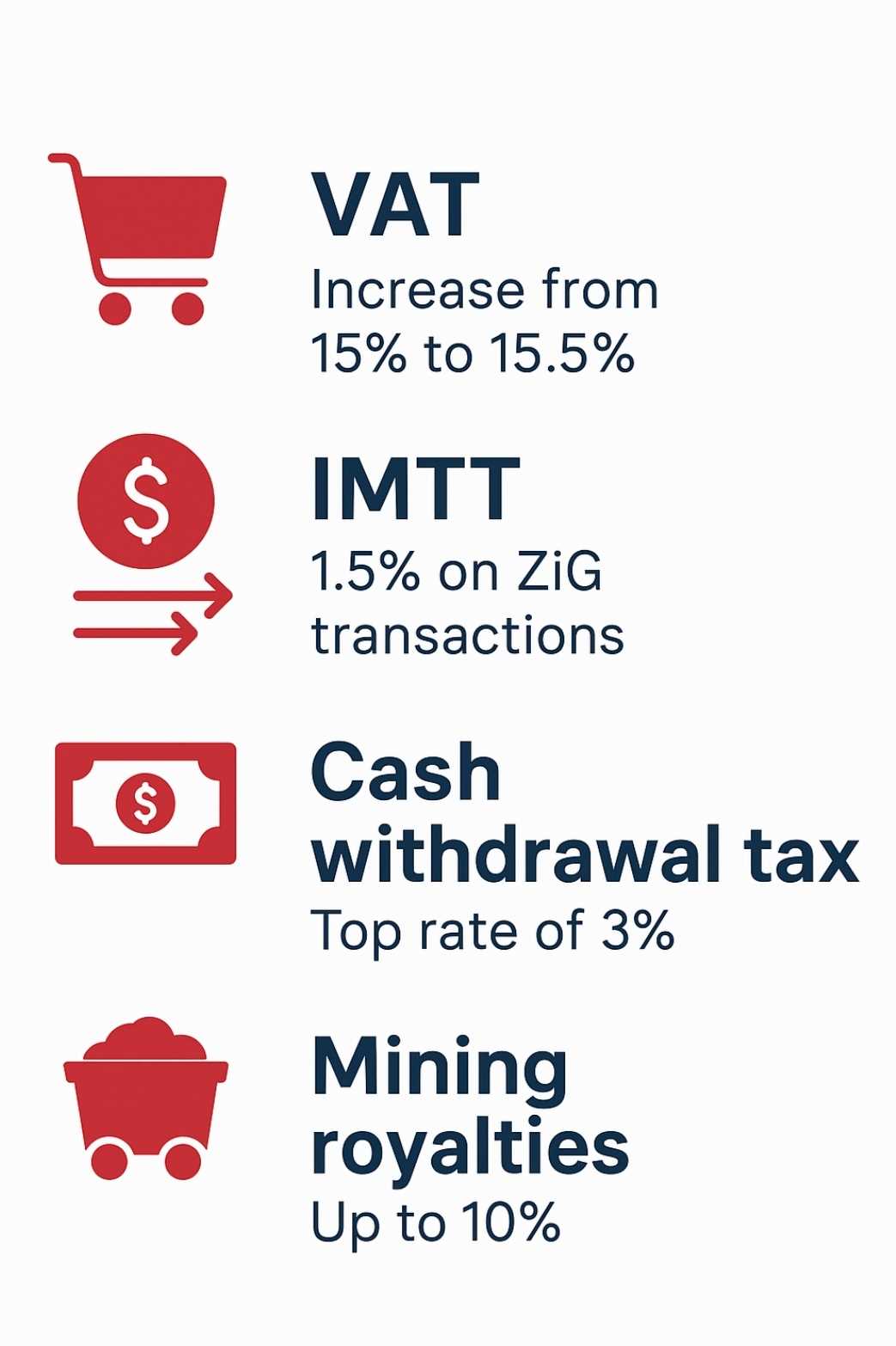

The Finance Bill proposes adjustments to VAT, transaction taxes, mining royalties, digital services taxes and a series of new levies meant to widen the tax base and promote formalisation.

VAT Increase Sparks Dispute Over Fairness

The Budget and Finance Portfolio Committee endorsed Treasury’s proposal to raise VAT from 15% to 15.5%, calling the increase modest, regionally aligned and essential for fiscal stability. It noted that basic goods consumed by low-income households remain zero-rated.

Opposition MPs rejected this position, arguing that even a marginal VAT hike would trigger price increases across the economy and worsen the erosion of purchasing power.

“Most transactions are now going to happen on a cash basis. Many people will not take their money to the banks, and that will not help this economy,” Dzivarasekwa MP Edwin Mushoriwa said.

Dual IMTT Rates Raise Fears of Market Distortion

The budget proposes cutting the Intermediated Money Transfer Tax (IMTT) on ZiG transactions from 2% to 1.5%, while keeping the 2% rate for USD transactions. Ruling party MPs praised this as an incentive to promote the local currency.

However, the Budget Committee warned that dual rates could distort the market by pushing more USD transactions into cash, undermining revenue collection and monetary policy. It recommended considering a downward adjustment for USD transfers to level the playing field.

Cash Withdrawal Levy Triggers ‘De-Banking’ Concerns

A new progressive levy on US-dollar cash withdrawals also drew mixed reactions. Treasury argues the measure will discourage large cash withdrawals, encourage digital transactions and curb forex leakages.

MPs across the aisle cautioned that the proposed top rate of 3% could drive informal and emerging businesses away from banks. The Committee urged Treasury to keep the levy “as low as practically possible” to safeguard financial inclusion.

Mining Tax Reforms: Balancing Revenue and Viability

Debate intensified around mining tax proposals:

Gold Royalty Adjustments

A revised sliding scale will push gold royalties to 10% when global prices exceed US$2,500/oz. The Committee said this reflects “economic rent” during price booms.

Industry players countered that the top rate is uncompetitive and could fuel smuggling. The Committee proposed raising small-scale miners’ royalties from the current 2% to as high as 5% above US$2,500/oz to reduce arbitrage.

Related Stories

Export Taxes and Beneficiation Push

New export taxes include:

- 10% tax on lithium ore and concentrate, with lithium sulphate exempt

- New levies on antimony, ferro-chrome, and processed black granite

Government says these measures promote beneficiation and retain more mineral value.

Mining firms warned that taxing concentrate while calculating royalties on refined prices threatens viability. The Committee recommended basing all royalties and export taxes on ZIMRA-determined prices for transparency.

Limits on Loss Deductions & New Capital Allowances

To curb abuse, the budget caps mining loss deductions at 30% per year. The Committee acknowledged this may strain firms with long project cycles.

Capital expenditure will now be amortised over the life of the mine rather than being fully deductible immediately. The Committee supported this uniform approach if it remains regionally competitive.

Digital Services and Betting Taxes Expanded

Treasury plans significant expansions in the taxation of digital platforms and gambling.

Digital Services Withholding Tax

A 15% tax on non-resident digital platforms aims to capture revenue previously outside the VAT system. The Committee cautioned that the rate risks double taxation and recommended reducing it to 10%.

Betting and Gaming Taxes

Tax hikes include:

- Bookmakers’ Tax rising from 3% to 20% of gross revenues

- Tax on punters’ winnings increasing from 10% to 25%

Government maintains these taxes are easy to collect and will boost revenue. MPs warned they could place a heavy burden on operators and gamblers.

Investment and Employment Incentives

Despite the tightening measures, the budget introduces incentives intended to spur investment and job creation. These include:

- Allowing IMTT to become a deductible expense for corporate tax

- Suspension of customs duty on raw materials for gas cylinder manufacturing

- Incentives to support 24-hour production, though MPs questioned feasibility

- BKPO incentives, including a 15% corporate tax rate, 100% first-year capital allowances, and employment tax credits to encourage youth hiring

Informal Sector: A Call for a Broader but Fair Tax Net

With the informal sector accounting for more than 75% of economic activity, MPs called for fairer strategies to expand the tax base. Some advocated broader use of transaction-based taxes like IMTT. Others warned against taxing informal traders before promoting meaningful formalisation.

The budget proposes migrating some operators—including transport services—from presumptive tax to income tax via self-assessment. The Committee said the approach could aid formalisation if supported by simpler systems and extensive taxpayer education.

ZIMRA Faces 59% Funding Gap Despite Higher Targets

ZIMRA is expected to collect ZiG 281.5 billion in 2026 but received only 41% of its requested funding. Officials told MPs they lack vehicles, scanners, field tools and full digital systems—constraints that weaken enforcement and compliance.

The Committee warned that underfunding the tax collector while tightening tax laws risks undermining revenue mobilisation. MPs called for investment in digitalisation, border surveillance and technologies such as drones to combat smuggling.

Leave Comments