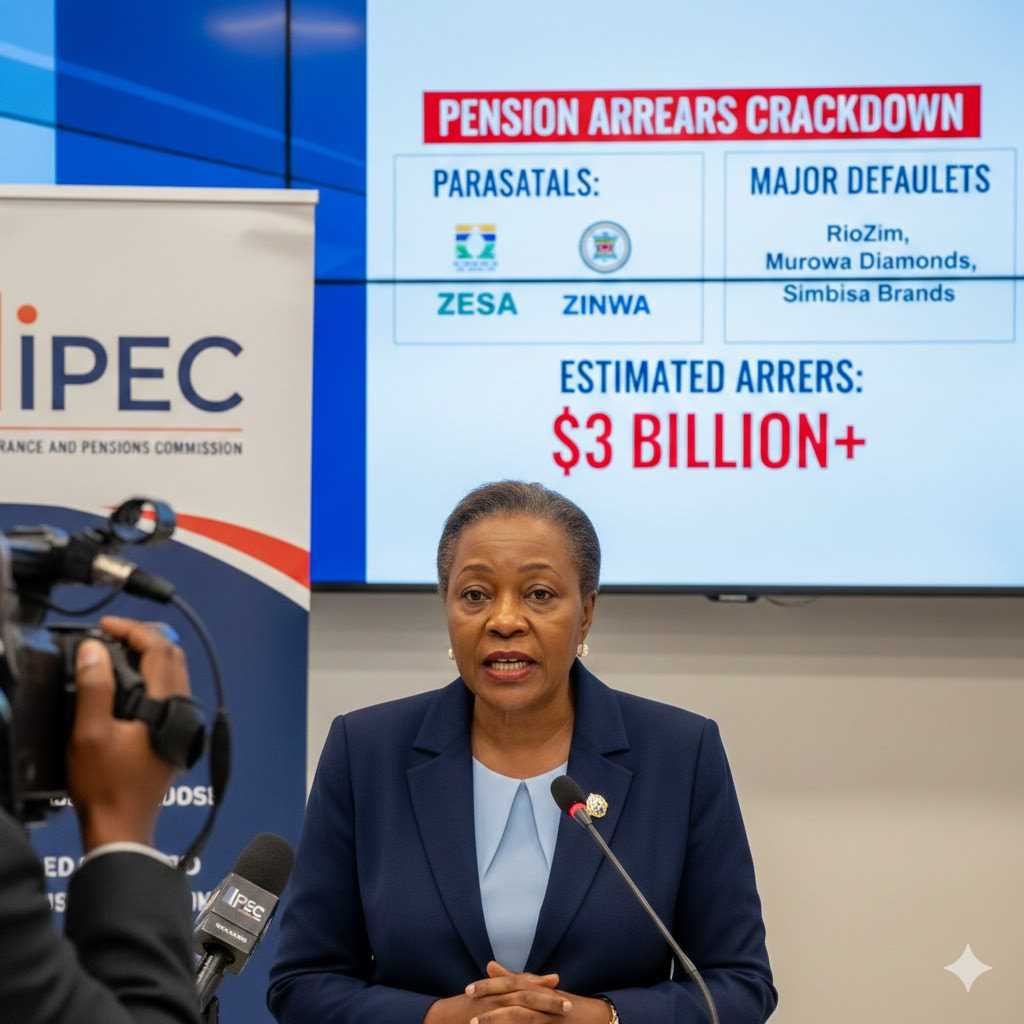

The Insurance and Pensions Commission (IPEC) has intensified its crackdown on non-compliant employers, publicly flagging several of Zimbabwe’s leading companies, parastatals, and local authorities for failing to remit pension contributions. This move signals a shift toward high-level accountability as the regulator seeks to curb a growing culture of non-compliance that threatens the financial future of thousands of workers.

Commissioner Dr. Grace Muradzikwa issued a definitive reminder that under the Pension and Provident Funds Act [Chapter 24:32], sponsoring employers are under a strict legal obligation to not only deduct contributions from salaries but also to remit those funds to registered pension schemes within the legally prescribed timeframes. Dr. Muradzikwa characterized these contributions as "deferred earnings," emphasizing that they represent a portion of an employee's current pay held in trust for their future.

Related Stories

The consequences of failing to pass these funds to the relevant pension entities are severe and multifaceted. According to the Commissioner, such failure directly prejudices members whose ultimate retirement benefits depend entirely on timely and consistent funding to generate investment returns. When an employer withholds these payments, it effectively strips the employee of the compound interest and market growth that would have otherwise accrued over their working life. Beyond the individual impact, IPEC warns that widespread non-remittance by high-profile organizations and public entities erodes national confidence in the entire pensions system, potentially discouraging future savings.

In her address to the industry, Dr. Muradzikwa urged all employers, including those in the public sector, to prioritize their remittance obligations over other operational costs. She noted that the commission remains committed to protecting workers' retirement savings and will continue to monitor the flagged organizations closely to ensure they return to full legal compliance. The regulator's stance remains firm: the safeguarding of retirement security is a non-negotiable legal and ethical mandate that all corporate and state entities must uphold to ensure a stable social safety net for the country's workforce

Leave Comments