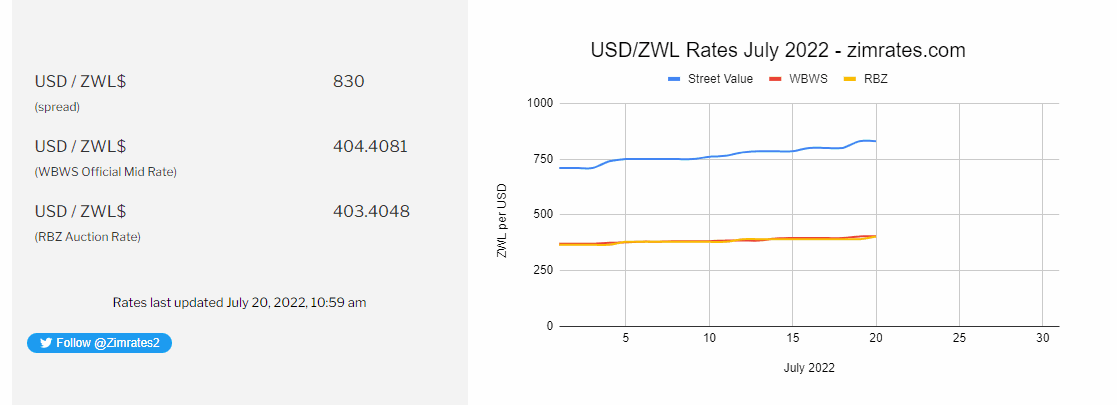

After losing a value of 200 units against the US dollar in 30 days, Zimbabwe’s ZWL currency does not appear set for a rebound any time soon.

Speaking to Quartz, Jee-A Van De Linde, an economist with Oxford Economics Africa, pinpointed on confidence as the missing crucial factor for sustainable value of the local currency:

“The fact that Zimbabweans are willing to pay premium prices for US dollars tells you that confidence in the local unit remains low,” Van De Linde said.

This is in spite of the measures that the Government is taking to protect value of the currency through interventions by the Reserve Bank of Zimbabwe.

Local economists and social media commentators have repeatedly hammered on the same issue.

Which is ironic considering that the Zimbabwean currency is struggling to maintain value against the fiat greenback, which many economists have pointed out as paper that is given value by nothing more than collective international confidence.

https://www.investopedia.com/articles/forex/09/factors-drive-american-dollar.asp

Let’s analyze the latest interventions to save the dollar and assess how they are failing on the confidence building front.

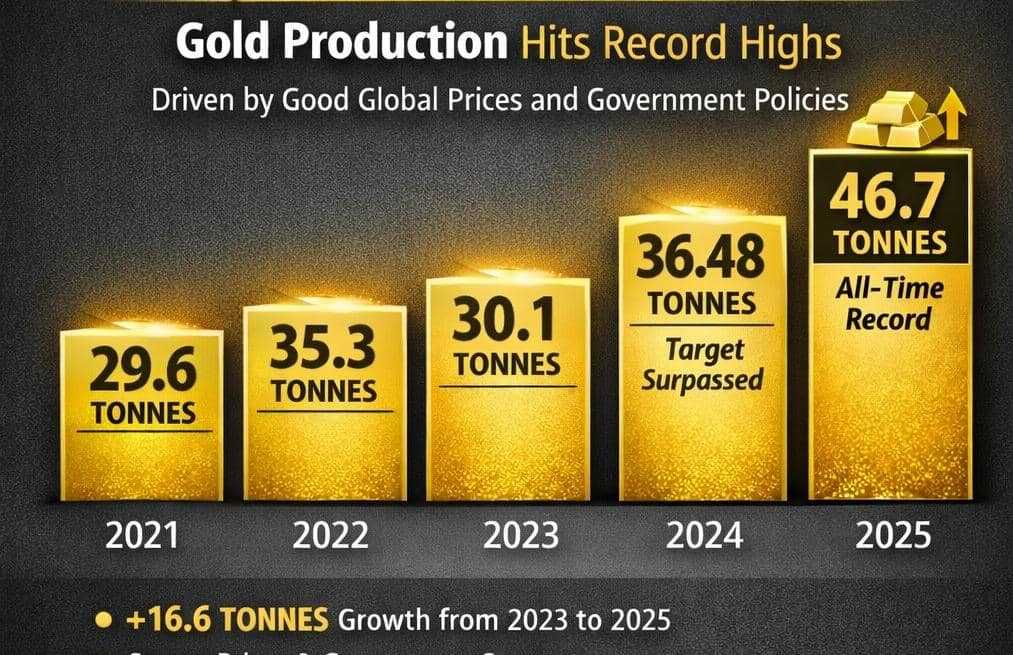

Gold coins

Set to be launched on the market on 25 July, the gold coins put Zimbabwe in tandem with countries like South Africa, Australia and the US in having gold coins as backup currency reserve vehicles.

In Zimbabwe’s case the RBZ has announced that the parallel market rate is being driven by individuals and organizations seeking to protect value of their cash holdings by speedily liquidating any excess ZWL holdings.

While the official markets wait for the official weekly auction rate to move value, development on the parallel market is fast. This in turn feeds the weakening of the ZWL as everyone works with predictive rates to minimize losses.

The gold coins are therefore meant to provide a viable, and legal, alternative to protecting value and hedge against international inflation, not just the ZWL volatility.

So far talk of the gold coin has not had an impact on the black market. In the 16 days since the intention to bring gold coins has been announced, the ZWL has continued to lose value at a steady pace, shedding 90 points

But this could simply be because until the coins are accessible, people need to protect value by continuing to offload ZWL. The big question is if that will change starting from nest week Monday when the coins become a practical factor.

Biggest challenge to uptake: the RBZ has announced that gold coins will have to be held for at least 180 days before holders can sell. In a country where most corporates cannot access foreign credit lines, it does not make sense for any organization to tie up its funds for such a long time.

Therefore, it is likely that temporary operational reserves will continue to be traded on the black market as businesses try to stay ahead of ZWL hyper-inflation.

What could be done: Another more flexible form of gold backed currency with smaller denominations that still conforms to Know-Your-Client regulation and whose trade is strictly monitored for use in daily transactions. Effectively this would mean gradual phasing out of the problematic ZWL and replacing it with a currency that people can believe in.

More regulation for large ZWL recipients

Related Stories

Many economic analysts have argued that the Zimbabwe government has been actively pushing down the value of the local currency through printing money. The government has spent large sums self-financing on infrastructure, notably the road rehabilitation and upgrade projects.

The Harare Beitbridge now has 340km of completed highway upgrade and there are numerous other completed phases around the country. But as the roads have been spreading, so directly has the ZWL been falling. And it is easy to link the large payments to resultant forex black market developments.

It seems the latest strategy for government is to follow the money it is disbursing to ensure that it does not end on the black market.

The latest announcement covers close monitoring of organizations receiving large payments from government by holding them to account on where payments are going. Government will also scrutinize tenders more closely to ascertain that is receiving fair value.

Numerous tenders where service or product suppliers have been alleged to be over paid, or paid for no delivery include the ZESA and Wicknell Chivhayo scandals and the more recent Pomona rubbish debacle featuring the City of Harare and the local authorities parent ministry headed by July Moyo.

So on paper it makes sense for government to have more insight on such organizations and demand that they account for where they are putting the money.

Challenge: This announcement on its own does not mean anything. Cases of the RBZ announcing freezing of accounts for those purported to be pouring ZWL into the parallel market have resulted in a big fat nothing. At the end of the day, it looks like there are discussions behind the scenes and the RBZ comes out as all bark and no bite. So no one really expects to see practical effect of this latest talk.

What could be done: The RBZ needs to bring the players to the table for a no holds barred meeting. That is the only way to come up with effective and practical ways to protect the local currency because tightening screws without considering survival of government contractor businesses is suicidal. The Big Brother approach should only come after there is a consensual blueprint on the way forward.

Other options

With more international payment platforms coming up, Zimbabwe should start weaning itself from the USD and turn to alternatives that are more friendly to its circumstances.

Joining the AU backed pan-African payment settlement system (PAPSS) means Zimbabwe will not need a third party currency for trade with signed up African countries:

https://www.iisd.org/articles/payment-system-boost-intra-african-trade

With very little trade with the US, Zimbabwe is better off joining its real national business partners such as China on alternate payment systems:

Reducing the grey and black economy scales:

Some estimates have put a USD7 billion value of Zimbabwe’s economy. Add the grey area of formal operators playing tricks to survive and be profitable, this means that the RBZ and other authorities are not fully in charge of the economy.

Zimbabwe needs to come up with measures such as carrots in the form of formalization incentives and leniency in requirements. This should be coupled with a very big stick to ensure that all unformalized operations become non-viable and unattractive.

Conclusion

The free fall of the Zimbabwean currency can be arrested if the RBZ puts more work into not only walking the talk, but talking the walk more effectively. Action speaking louder than words is a crucial for the RBZ to engender stakeholder confidence. Communication is a key and it is high time that the Zimbabwe currency is packaged into an attractive story.

Leave Comments