Edmore Zvinonzwa

A number of Zimbabweans have said they are abandoning their nostro accounts and will no longer be accepting telegraphic transfers, opting for cash transactions.

“I am withdrawing everything in my account and closing it immediately. The next thing we will be hearing is that the nostro accounts are being liquidated into RTGS at official rate,” one client in a bank told this writer who was standing in queue to get the sentiments of the banking public.

Others in the longish line at the bank agreed and did not seem placated by the fact that the bank appeared to have adequate cash for all withdrawals.

FBC has dismissed the social media messages attributed to the financial institution as fake news.

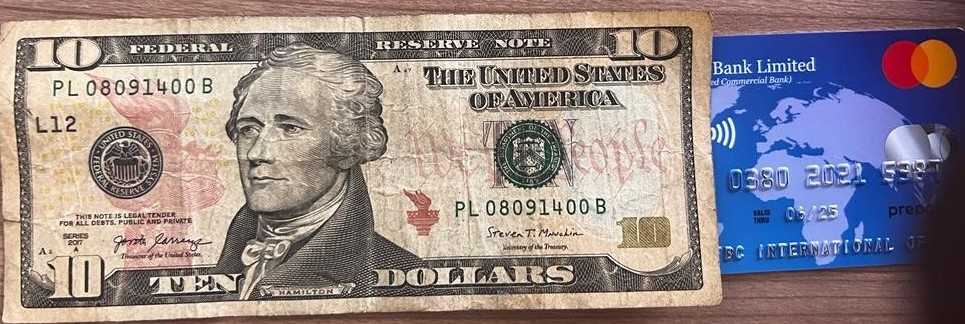

“Our attention is drawn to social media messages purporting that FBC Bank intends to deactivate MasterCard services and other USD based transactions.

“As a matter of fact, the reliable FBC MasterCard remains operational for executing local and international transactions, online as well as on all MasterCard branded terminals across the globe. This is in line with the bank’s unwavering commitment towards ensuring the provision of a secure, convenient and reliable platform for anyone in Zimbabwe and abroad to transact using the FBC MasterCard card,” said FBC Bank in a statement.

Political activist Hopewell Chin’ono, who started the panic with his tweet backtracked on his earlier assertions saying that he had spoken to the RBZ governor, who disassociated the central bank from the alleged communication from the banks.

“He (Dr John Mangudya) says that liquidity in the market is fine, and that people with Nostro accounts should not panic.

“He said that the banking sector is seated on around 60% of forex liquidity in both forex cash and forex balances at corresponding banks.”

An FBC Bank client, who requested anonymity said the bank had sent no such communication to its clients but confirmed that there is now a restriction on transferring money from nostro accounts to MasterCard:

“I have not received any communication from the bank and I just saw it on social media. When I went to the bank yesterday, they said I could no longer transfer money directly from my nostro account to my MasterCard. But they allowed me to withdraw cash from the nostro and deposit in the MasterCard with no problem at all.”

Related Stories

The client said this is inconvenient and an extra cost that is not necessary.

“It is just cumbersome and more expensive. I think it is unfair and the banks just want to make more money because instead of one transaction, I am now charged for two. Banking is already expensive in Zimbabwe and this is ridiculous.”

Stanbic Bank said their clients’ MasterCard service remains operational and clients can continue to transact as normal.

“Kindly note that your VISA cards are safe. You can continue to transact locally on any of our ATMs and POS machines and internationally for online payments and withdrawals at any VISA/MasterCard ATMs,” said Stanbic.

Inquiries sent to BancABC had not been responded to at the time of writing.

A source at one of the financial authority institution in the country said that banks had noted some behaviour which could be classified as externalisation and rent seeking.

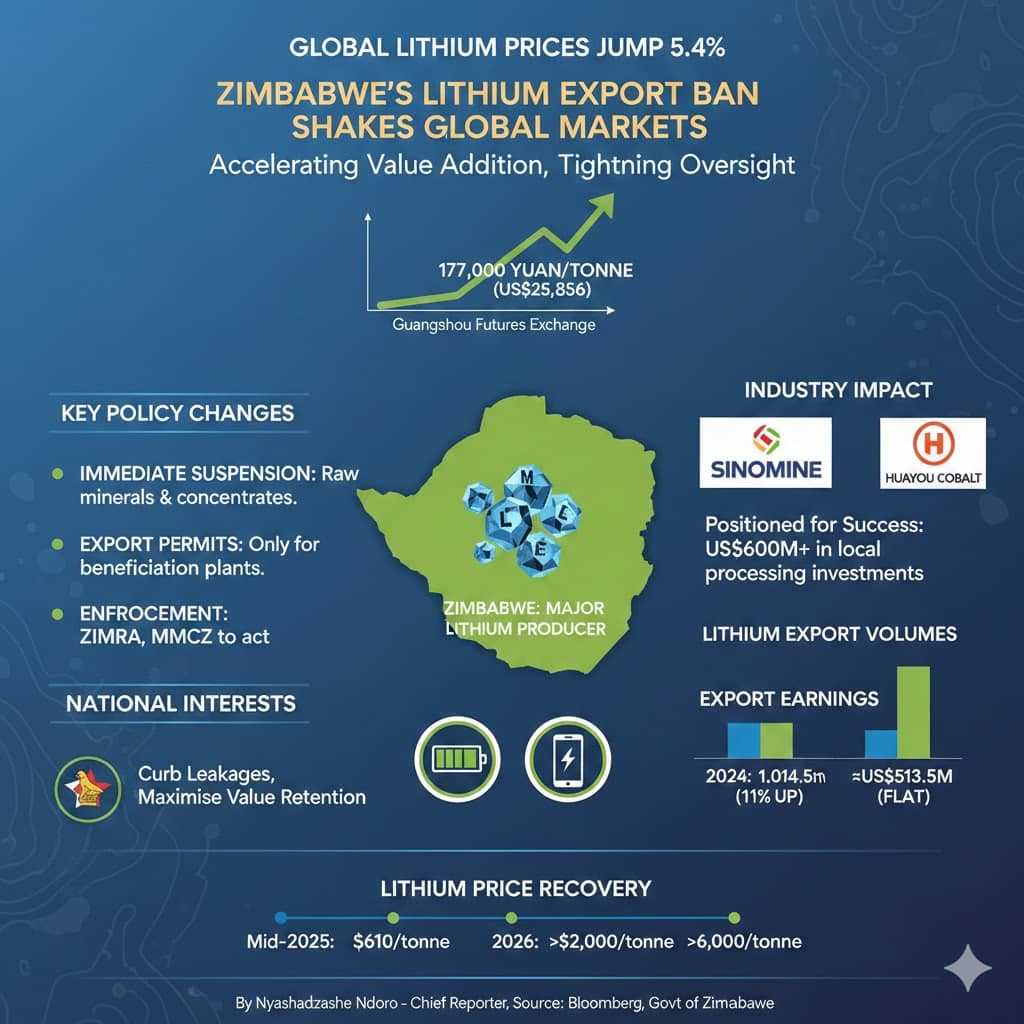

“There are clients who have started receiving large transfers into the nostro accounts which they immediately transfer to MasterCard and other international accounts. This is a way of siphoning USD from the country to external holdings.”

The source also said some companies are now opting for cash transactions to avoid paying taxes in USD as per new government directives.

“Companies are now required to pay tax in the currency of the transaction. So, to avoid paying in USD, they are converting to undeclared cash transactions,” the source said.

A nostro account is a bank account that a bank holds with a foreign bank in the currency of the country where the funds are held. But nostro accounts in Zimbabwe which were created in 2020 to allow localised digital USD transactions do not appear to be necessarily linked independent reserves held in foreign countries.

While Dr Mangudya has dismissed allegations of nostro accounts being non-existent USD fabrications, the public is not taking his statement at face value and many people are likely to avoid keeping any money in the bank.

With faith in the local currency at very low levels, and the background of total loss in two currency upheavals over the past two decades, the Zimbabwean public will need strong reassurance to trust nostro accounts into the future.

Leave Comments