Philemon Jambaya and Edmore Zvinonzwa

Zimbabweans have expressed wariness on the firming of the Zimbabwe dollar by 500 points (8.6 %) on the Reserve Bank of Zimbabwe Auction platform against the USD, as confidence and trust in the financial authorities remains low.

A number of people on social media and on Harare streets told Zim Now that while the local currency rates on the black market have fallen there is nothing to indicate that the economy is going into a positive phase.

“Prices in the shops have not gone down. They are still prohibitive. Until we begin to see sanity in the shops, it is hard to say things are moving in the right direction,” said a man shopping in one of the big name supermarkets in the CBD. He declined to be identified.

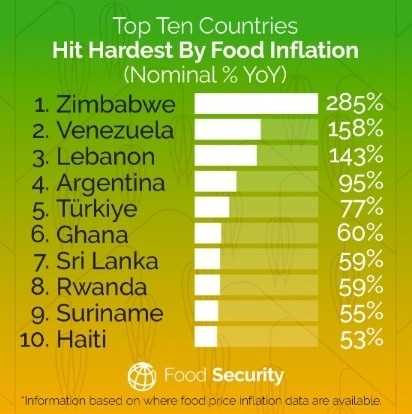

Inflation jumped up from 87% to 176% over a one month period running from May into June.

A social media influencer said the issue of foreign influence on goings-on in the Zimbabwean economy means that things are not really under control and so as long as the USD is the preferred currency of transaction, the situation will remain volatile.

“This is election year and anything is possible. There are people who want things their way. Zimbabwe has resources which many big countries are after. So one cannot rule out manipulation of the economy by external forces working with internal saboteurs,” she said.

She declined to be named as she said that social media is a repressive space and sentiments that do not support a specific opposition party result in abuse and bullying.

Finance manager for an FMCG, Maud Tenhedza said it is difficult to feel hopeful because the stop-gap measures do not address the underlying issues:

“Some things are just obvious. For a long time, the local currency was stable. So, it’s clear that the Reserve Bank of Zimbabwe does not print money, there is nothing to drive up the rates,” said Tenhedza.

Political activist Hopewell Chin’ono said the current firming of the Zimbabwe dollar has happened before and the stability will be temporary as the central bank has induced an artificial starvation of the local currency on the streets by not paying government contractors.

“Can the central bank sustain its liquidity crunch? No it can’t and it won’t! WHY? Because Government contractors haven’t been paid, including parastatal contractors like Zupco who rely on government payments.

Related Stories

“If contractors are paid, they will flood the Black Market looking for US Dollars and the local currency will crash again.

“That is why I said in my opening remarks that the patient has not been cured, they simply starved the patient and are celebrating that artificial response,” Chin’ono tweeted.

Government stepped in with a raft of measures in Q3 2022 when runaway inflation once again threatened viability of the local currency. The measures seemed to work until the end of Q1 2023 when the situation once again went out of hand.

Tenhedza said that responsibility for economic stabilisation and creating trust in the local currency lies squarely with the government.

“Government needs to come up with a fair and sustainable way of paying genuine contractors without triggering inflation. We also need effective legislation that gives out punitive punishment to looters of public funds as individuals.

“Currently, they are being protected. We are told that some entities have been blacklisted. But their names are not publicised. Where entities are named, the ownership of the entities is not stated. So, it means the same individuals can just continue looting using different companies,” said Tenhedza.

Confederation of Zimbabwe Retailers president, Denford Mutashu said business should respond positively to current circumstances.

“CZR urges business to respond to the stability in the exchange rate by pricing responsibly. Expectation is to begin to see prices falling in line with key economic indicators like stability in exchange rates, improved power supply and government measures,” he said.

A well-known economic analyst said that the RBZ governor has failed and should be dismissed and a new person appointed.

“I personally think John Mangudya must be kicked out for his Gonomics and we get a new broom that can work with the Finance ministry in its attempt to clean up government procurement. The hyperinflation means that the person printing the money is the one benefitting. Period. Without removing the current regime at the central bank, relief will be short lived as they will soon revert to what they do best,” said the analyst.

President ED Mnangagwa recently signed a statutory instrument clipping Mangudya’s freedom to print money freely under the guise of procuring forex for government. This mirrors the same manner that former RBZ governor Gideon Gono worked leading to the demise of the Zim dollar in 2009 when the country dollarized after inflation hit 231 000 000% and beyond.

“Currency stabilisation is very easy if government is disciplined, transparent and accountable,” said Tenhedza.

So once again, the Zimbabwean public is resigned to take each day as it comes with no clear indication that the local currency can be stabilised sustainably.

Leave Comments