Audrey Galawu

Assistant Editor

Proplastics Limited, a leading manufacturer in the plastic piping industry, has released its unaudited financial results for the half-year ending June 30, 2024.

The company reported a comprehensive loss of US$71 875, a significant decline compared to the profit of US$561 298 recorded in the same period in 2023.

Revenue for the period dropped by 18% to US$8.6 million from US$10.4 million in the first half of 2023.

The group attributed this to a subdued demand for its products, largely due to exchange rate volatility, liquidity challenges, and delays in fiscal policy announcements.

Proplastics' gross profit also fell by 24% to US$2.5 million, down from US$3.3 million in the prior period.

The group’s earnings before interest, tax, depreciation, and amortisation were down 37%, settling at US$1 million from US$1.6 million in 2023. Profit before tax saw a 58% decrease, landing at US$418,000 compared to US$1.1 million in the previous year.

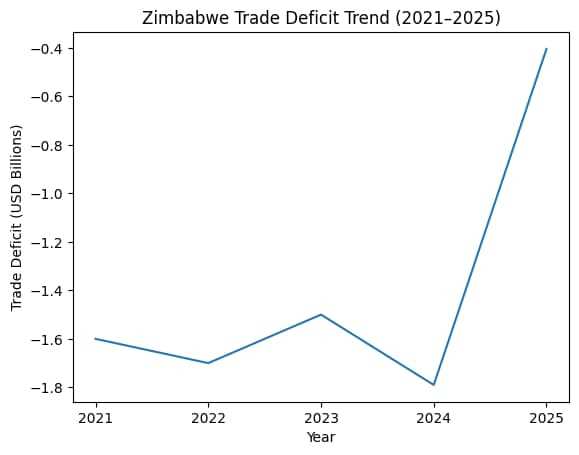

The company's operations were severely impacted by the country’s economic conditions, including exchange rate fluctuations and power outages. During the first quarter, the Zimbabwean Dollar lost over 380% of its value, creating significant trading difficulties.

Related Stories

The introduction of the Zimbabwe Gold currency by the Reserve Bank of Zimbabwe in April 2024 initially helped stabilise prices, but limited liquidity slowed Proplastics’ recovery efforts.

Additionally, power supply challenges forced the company to rely on expensive generators, further eroding profit margins. According to the company’s report, energy expenses will likely decrease in the second half of the year due to the installation of a solar plant, which is expected to generate 50,000 kWh of energy per month.

Despite these challenges, Proplastics maintained a relatively strong balance sheet, with total assets of US$22.1 million as of June 2024, down slightly from US$22.8 million in December 2023.

The group’s cash and cash equivalents stood at US$268 000 by the end of the period, following a US$33 000 decrease.

Net cash from operating activities amounted to US$ 451 000, down from US$670 000 in the previous period, while financing activities generated a positive cash flow of US$448 000.

Looking forward, Proplastics remains cautiously optimistic. The group anticipates continued challenges due to liquidity constraints and the ongoing impact of the El Niño-induced drought.

However, several government and NGO initiatives aimed at addressing water scarcity may boost demand for the company’s piping products in the latter half of the year.

In a bid to recover, the company plans to install additional equipment to enhance production capacity and improve efficiency. Proplastics is also hopeful that its new solar plant will significantly reduce operational costs, allowing it to maintain competitive pricing in a tough economic environment.

Leave Comments