Audrey Galawu

Assistant Editor

ProPlastics, a leading player in Zimbabwe's piping and fittings industry, reported a challenging trading environment for the first nine months of 2024, marked by declining sales and revenue. The company’s performance was heavily impacted by macroeconomic and operational constraints, according to its trading update for the period ending September 2024.

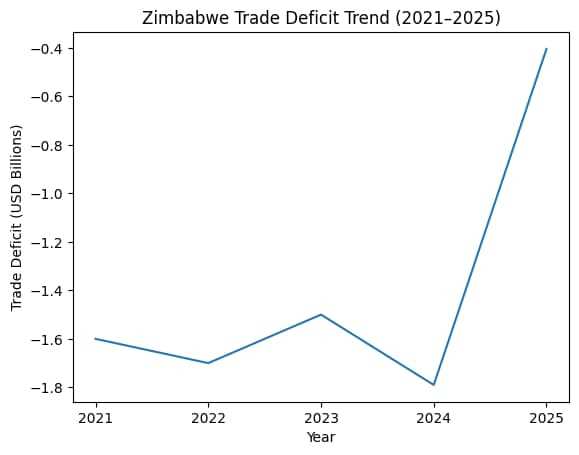

The introduction of a new currency initially stabilised the exchange rate but later resulted in volatility due to limited availability. This led to a 43% devaluation, causing market disruptions.

Government prioritisation of road infrastructure projects diverted focus from water and sanitation initiatives, limiting potential revenue streams.

Related Stories

Prolonged power outages affected production efficiencies, despite the company’s use of solar and generator backups.

Sales volumes dropped by 4% to 4,800 tons compared to the same period in 2023, revenue decreased by 10%, from US$16.16 million to US$14.52 million, mirroring the decline in sales volumes, production volumes fell by 5%, though the company managed to fulfill backorders and maintain inventory levels.

Overall profitability declined compared to the previous year, driven by a reduction in sales and continued economic pressures.

ProPlastics anticipates a rebound in the final quarter due to the rainy season, which typically accelerates project completions. Additionally, newly installed equipment is expected to enhance production capacity, increasing product availability and supporting higher sales volumes.

However, persistent electricity supply challenges remain a concern. To counter these issues, the company successfully commissioned a solar project in Q3, which is expected to alleviate power-related disruptions moving forward.

ProPlastics continues to emphasize operational efficiency and resilience in navigating Zimbabwe's volatile economic landscape. With these strategies, the company aims to stabilize performance as it heads into 2025.

Leave Comments