Not much will change following elections in Zimbabwe but the country remains company’s most stable asset, the head of Zimplats’ holding company Implats Nico Muller says.

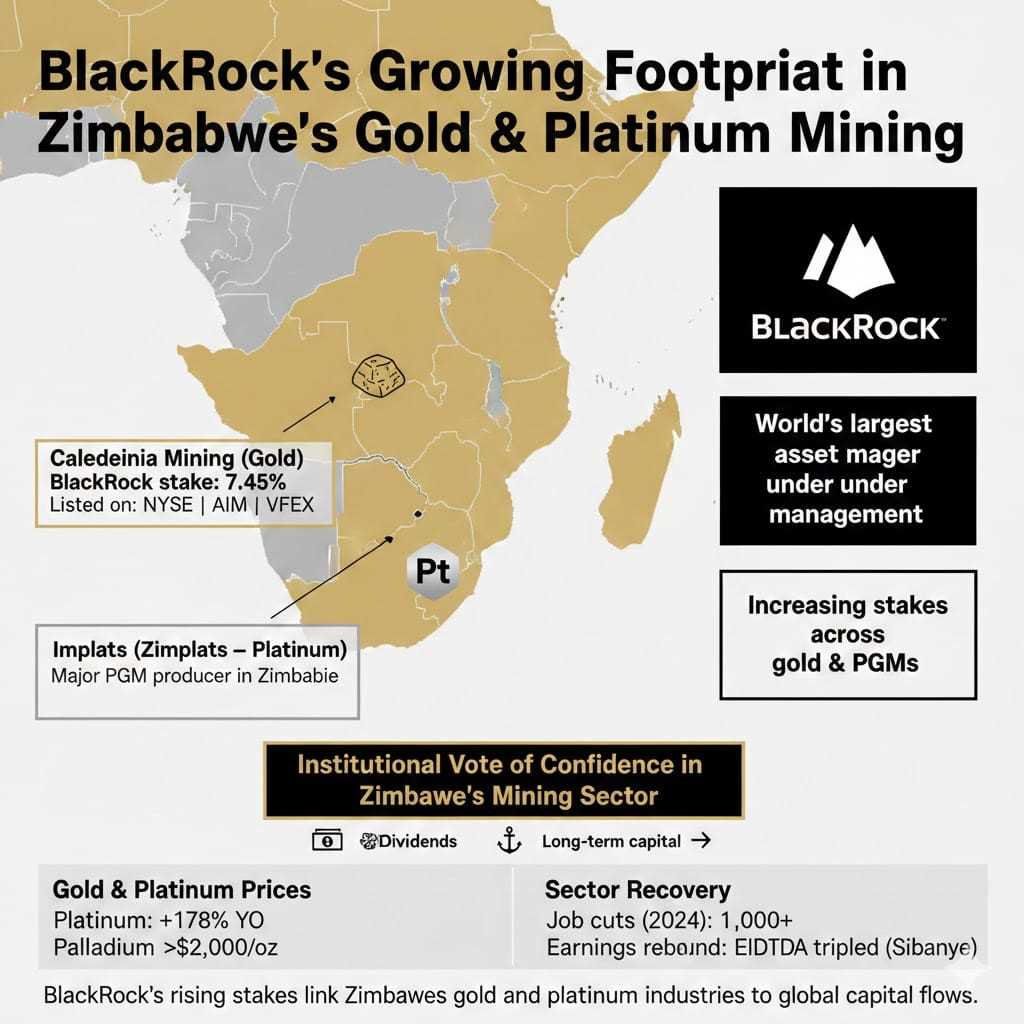

The company in 2021 announced a US$1.8 billion investment in Zimbabwe to expand mining and processing operations, the single largest FDI commitment over the past five years.

But as political controversy rages over the election, Muller says there is nothing new. If anything, he says, despite the country’s troubles, Zimbabwe remains Implats’ most stable asset.

Speaking to South Africa’s Moneyweb on what the continuation of the status quo mean for his business in the foreseeable future, Muller responded: “Operating in Zim is always a contradiction for us, because for the last two decades, we’ve had a presence there. There’s always been policy uncertainty. We’ve always had human rights questions. We always have had elections in which the outcome has been disputed.

“The very interesting thing is it is probably the most stable part of the group operations. So, for instance, now with the elections, we did not have an impact at our operations as a consequence of the voting, the election process – neither the outcome.”

Related Stories

Implats, he says, chooses to be active in the country rather than look from the outside.

“It always remains our position that to be an active player in the country while operations remain stable is far more favourable than being an observer from the outside. So, we still have frequent engagements with various parts of the government, and we continue to attempt to play a positive role and influence with regards to human rights, policy certainty, and all of those things that create jurisdictional risk.”

Earlier this week, Zimplats announced in its full-year results that it has spent US$304 million over the past year on new projects. This includes new mines and additional processing capacity, including work on a base metal refinery.

However, Zimplats is not sheltered from Zimbabwe’s problems. Like much of the region, Muller says, Zimbabwe’s power deficit means the company has to secure its own energy. It will take “a decade or two” for Southern African power supply to catch up with demand.

Says Muller: “That’s also what’s driving our own initiatives towards establishing a greater supply of renewable energy from independent sources.”

While importing 50 MW from Zambia, Zimplats has started building a new 185MW solar plant. - Zim Now Writer/Moneyweb

Leave Comments