Nyashadzashe Ndoro

ZIM NOW REPORTER

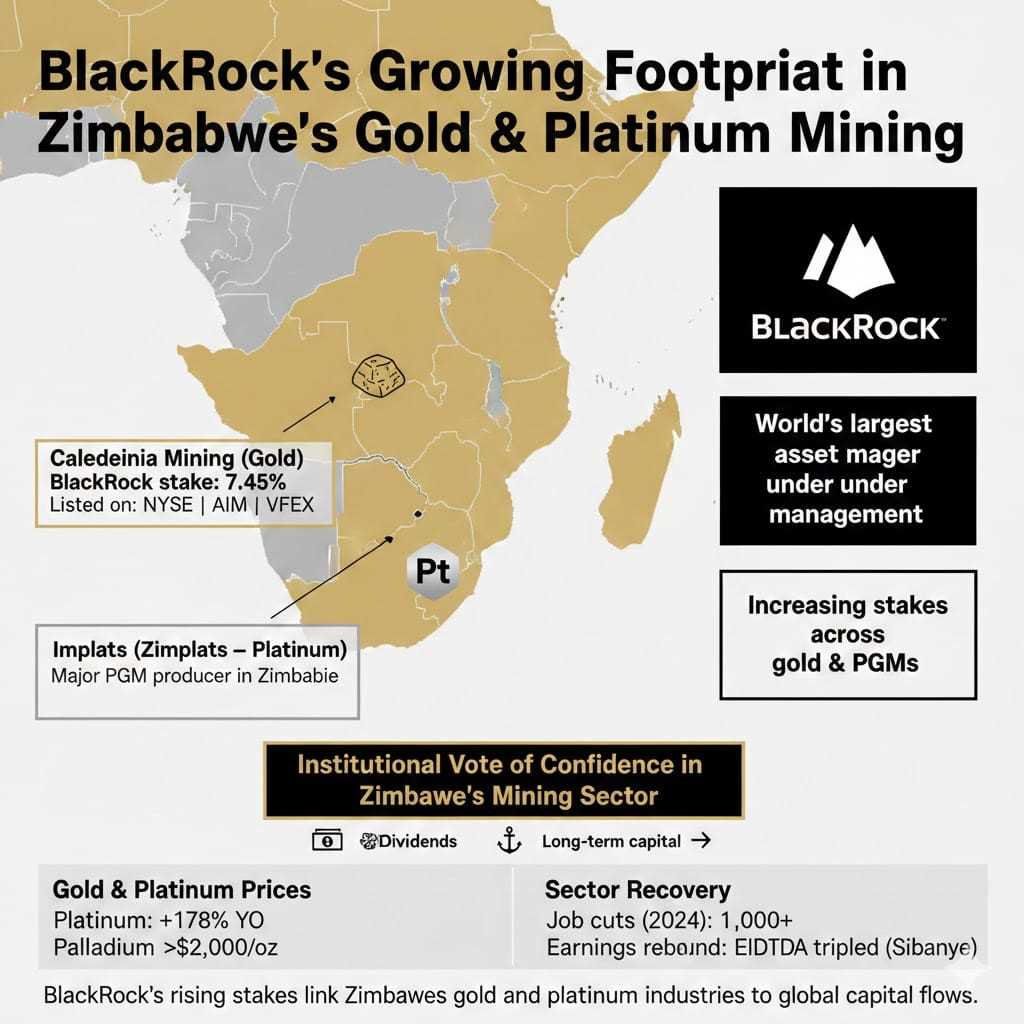

Zimplats, Zimbabwe’s largest platinum group metals producer, downplayed any potential impact from Zimbabwe’s recent introduction of a gold-backed currency, ZiG, despite announcing plans to reduce its workforce by 1% in response to falling metal prices.

“It is not a threat to us,” said Zimplats CEO Alex Mhembere, speaking at a PGM mining conference in Johannesburg recently. “We operate in United States dollars. This is a local currency and it will not affect our business.”

The move, affecting roughly 80 employees from the company’s current headcount of 8 000, is part of a broader cost-cutting strategy.

Related Stories

The decision comes amidst a slump in global PGM prices due to weak auto production and fears of an economic slowdown. This has squeezed profits for PGM miners across Southern Africa, including Zimplats’ parent company Impala Platinum, Sibanye Stillwater, and Anglo American Platinum, all of whom have implemented job cuts in recent months.

Mhembere said they were not implementing job cuts, but only aimed to maintain its annual output of around 600 000 PGM ounces by focusing on improvements in productivity.

The company will also be tightening its belt on its previously announced US$1.8 billion, 10-year expansion project. Mhembere described the upcoming financial year, starting in July, as one of being “capital light”.

“We’re going to spend less,” he explained. “We will only be focusing on our replacement capital expenditure, stay-in-business capex and very little on growth capex.”

The shift in spending priorities means deferring some projects, such as a sulphur abatement initiative and the second phase of a solar power plant.

Leave Comments