Zimbabwe’s equities market has recorded broad-based gains in 2025, buoyed by firm commodity prices, the stability of the Zimbabwe Gold (ZiG) currency, and renewed investor confidence amid improving macroeconomic fundamentals, according to the latest IH Securities equity strategy report.

Globally, the International Monetary Fund (IMF) projects growth at 3.2% in 2025, up from 2.8% earlier in the year, reflecting resilience despite U.S. tariff escalations that initially threatened global trade. Many economies reportedly mitigated the impact by redesigning trade routes and strengthening supply chains.

Inflation has eased worldwide, with headline inflation forecast to decline to 4.2% in 2025 from 5.8% in 2024, although tariff-related costs and higher wages in developed economies persist. Commodity markets softened by 6.6% year-to-date, largely due to weaker energy prices following OPEC’s production adjustments and easing geopolitical risks after the Gaza-Israel ceasefire.

However, the downturn in oil and food prices, driven by a 3.8% increase in global agricultural output and India’s lifting of export bans, was partly offset by a strong rally in precious metals, particularly gold, which rose 81% year-to-date as investors sought safe havens. Central banks have adopted moderate monetary stances, with marginal rate cuts expected in the U.S. and Europe to balance growth and inflation management.

Zimbabwe’s economy remains on a recovery path, with GDP growth projected at 6% in 2025, supported by an upward rebasing of the 2024 GDP to US$45.7 billion. The rebound is attributed to a 21.1% surge in agricultural output, strong manufacturing and mining performance, and a more stable exchange rate under the ZiG.

Foreign reserves have improved to US$900 million, equivalent to one month of import cover, while inflation continues to moderate. Fiscal revenues have exceeded targets, and the debt-to-GDP ratio has improved to 46.5%.

Despite these gains, liquidity constraints, low credit growth, and limited confidence in the local currency continue to weigh on private-sector expansion. The government expects annual growth to average 5.9% between 2026 and 2029, though the African Development Bank, IMF, and World Bank project a slowdown to 4.6% in 2026 due to persistent foreign exchange and inflation pressures.

The Victoria Falls Stock Exchange (VFEX) has been the standout performer, with market capitalisation up over 40% year-to-date, driven by new listings such as Eagle REIT and Kavango Resources, alongside record block trades and rising demand for gold-linked and consumer-facing counters.

Liquidity has deepened significantly, with average daily turnover rising 197% to US$0.48 million in the first nine months of 2025, compared to US$0.16 million in the same period last year. First Capital Bank (FCB) led activity with 1.13 billion shares traded in a record February block deal worth US$42.4 million, followed by Innscor, which saw US$20.5 million in trades.

Padenga Holdings emerged as the best-performing stock, gaining 201%, followed by Zimplow (100%) and FCB (82.7%), while SeedCo International declined 10.5%.

Related Stories

New listings, including the upcoming Pfuma REIT, are expected to sustain interest in the VFEX, whose market capitalization growth has outpaced regional averages.

The Zimbabwe Stock Exchange (ZSE) has also shown moderate recovery, with capitalisation up 12.9% year-to-date to US$1.99 billion. Stability in the ZiG currency and stronger corporate earnings have supported investor engagement, even as tight liquidity limits trading volumes.

According to IH Securities, investor sentiment remains cautiously optimistic, supported by strong gold prices, stable monetary conditions, and a robust agricultural season likely to boost consumer liquidity.

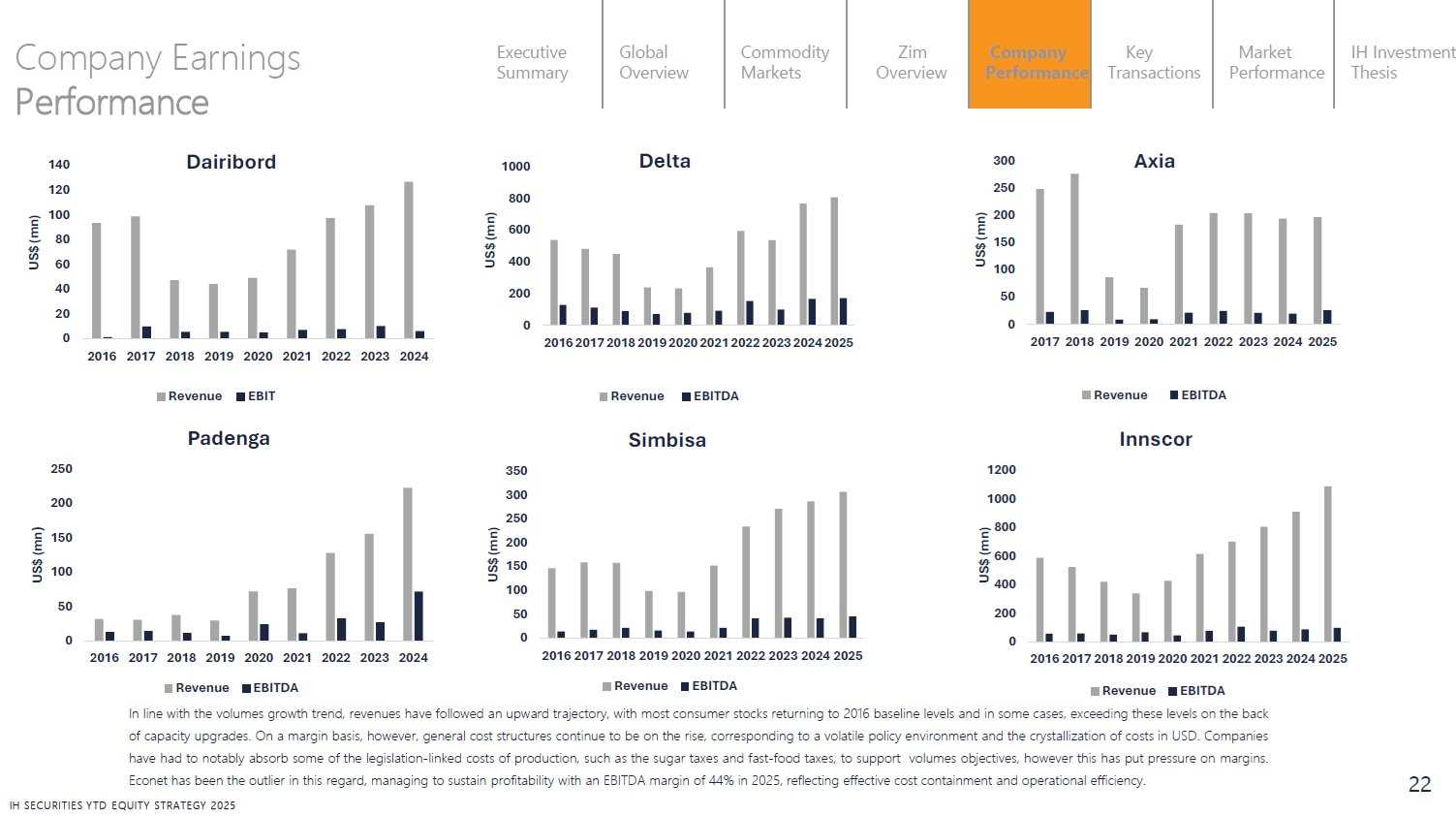

Across listed companies, revenue and profitability have continued to strengthen:

Innscor and Simbisa Brands reported steady earnings growth driven by efficient cost structures and expanding regional operations.

Delta Corporation and Dairibord saw strong rebounds in sales volumes and margins post-2021.

Padenga Holdings leveraged high gold prices to achieve record profits.

Axia Corporation maintained stable growth amid improving consumer spending.

Overall, most firms have returned to pre-2020 performance levels, with an average EBITDA margin of 6.4% in 2025, reflecting effective cost control and improved operational efficiency.

IH Securities expects the monetary environment to remain delicate, with liquidity constraints continuing to suppress stock market activity.

Leave Comments