Audrey Galawu- Assistant Editor

Zimbabwe’s ambition to become an upper-middle-income economy by 2030 is being stifled by one of its biggest internal contradictions: a tax regime so heavy and complex that it threatens to derail private sector growth, discourage formalisation, and weaken competitiveness across industries.

According to the 2024 National Competitiveness Commission Report, the country’s layered tax system — from corporate tax and VAT to numerous regulatory fees — is doing more harm than good, especially to manufacturers and small businesses.

“The high tax burden in Zimbabwe doesn’t align with the goal of becoming an upper-middle-income economy,” said Dr. Prosper Chitambara, an economist.

“To achieve that status, we must promote private sector investment, and the best way is to lessen the tax burden — especially direct income taxes, which have the most damaging impact on business viability.”

A Tax System That Bites — Hard

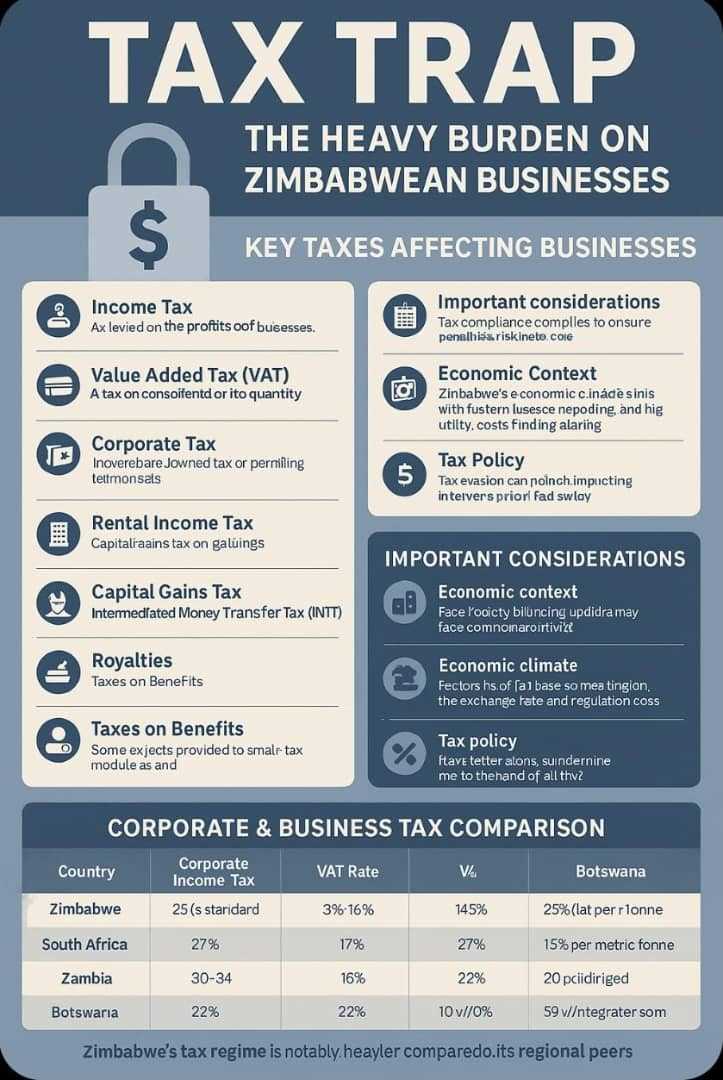

Zimbabwean businesses face an exhausting list of taxes and levies, including:

Corporate Income Tax: 25% flat on profits

Value Added Tax (VAT): ~15%

Withholding Taxes: On salaries (PAYE), services, and transactions

Rental Income Tax: 25% on commercial rentals

Capital Gains Tax: On the sale of property or marketable securities

Intermediated Money Transfer Tax (IMTT): 2% on mobile and electronic transactions

Royalties: Varying rates for mining companies

Fringe Benefit Tax: On employee perks like school fees or discounts

Compliance costs are worsened by ZIMRA’s aggressive enforcement practices, including penalties issued even when the state owes firms money. This has resulted in reduced cash flow, low reinvestment, and shrinking industrial capacity.

For Zimbabwe’s small business owners, taxes are more than a burden — they are a barrier to growth. Synthia Mhere, CEO of ProEngine, said her business struggles to survive formalisation costs.

“We’re informal traders forced to register and comply, but we can’t afford all the costs,” she said. “If we raise prices to keep up, we lose customers. So, there’s no growth — just hand to mouth.”

Her company pays over US$600 annually just for licensing and compliance, not counting rent and utilities. She says consultations with small business owners and scaled tax models would ease the strain.

Related Stories

Sugar Sector Spat Reflects Cost Pressures

The recent clash between Delta Corporation and local sugar producers Hippo Valley and Triangle Limited highlights just how damaging high production costs can be to industry relations.

Delta, which bottles Coca-Cola products locally, accused sugar producers of failing to meet both quality and pricing standards. The beverage maker argued that imported sugar is cheaper — around US$800 per tonne, compared to US$890–900 locally, excluding duties.

Hippo and Triangle rejected the claims, saying their sugar is compliant with international standards and fortified with Vitamin A. They blamed high local prices on Zimbabwe’s expensive operating environment — including power shortages, high interest rates, and logistical costs.

In 2023, the suspension of sugar import duties allowed foreign brands to capture up to 25% of the local market. The government has since reinstated duties, but the sector is still recovering.

“We should be using sugar produced locally,” said Parliamentary Finance Committee Chair Clemence Chiduwa. “Producers and users must find common ground.”

The case illustrates how cost structures — heavily influenced by taxation and regulatory inefficiencies — are sparking tensions even among local industries.

Zimbabwe vs. The Region: Losing Ground?

A comparison with regional peers shows Zimbabwe is taxing itself out of competition.

Country Corporate Tax VAT Capital Gains Tax SME Incentives

Zimbabwe 25% ~15% Yes Few

South Africa 27% 15% Yes Moderate

Zambia 30–35% (sectoral) 16% No Strong (MFEZ, agri)

Botswana 22% 14% Low/Integrated Strong (SEZs: 5–10%)

Botswana offers tax rates as low as 5% in Special Economic Zones (SEZs), while Zambia incentivises agriculture and exports. Even South Africa, despite a slightly higher corporate rate, benefits from stronger infrastructure and investor confidence.

The NCC and experts alike call for a shift in approach. Instead of piling on levies, Zimbabwe should be incentivising formalisation and investment.

“By lowering taxes, you encourage informal businesses to register. That way, the tax base grows naturally,” said Chitambara.

Recommendations include: Reducing direct tax rates, simplifying compliance for SMEs, revising ZIMRA’s penalty structure and aligning policy with regional peers to attract capital

Leave Comments