Zimbabwe is rolling out a broad slate of high-value investment opportunities as it steps up efforts to attract both local and foreign capital into strategic sectors of the economy.

The Zimbabwe Investment and Development Agency (ZIDA) has unveiled a diversified portfolio of projects under its 2025 investment pipeline, spanning manufacturing, infrastructure, energy, transport, housing, and agriculture. The pipeline reflects the government’s push to accelerate industrial growth, modernize aging infrastructure, and close long-standing production gaps that have constrained economic expansion.

At the heart of the strategy is a deliberate pivot towards local industrialization, import substitution, and export-oriented manufacturing, positioning Zimbabwe as a competitive production hub for the Southern African region.

Rail revival anchors manufacturing drive

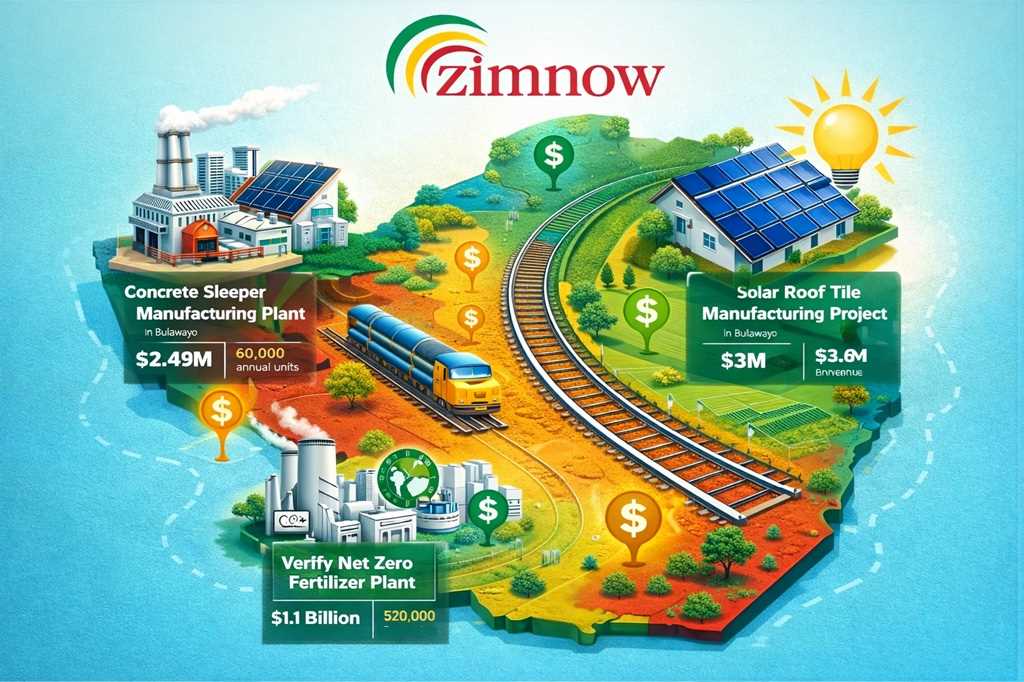

Among the flagship initiatives is the National Railways of Zimbabwe Concrete Manufacturing Plant Project in Bulawayo, which seeks to establish a concrete sleeper production facility with an annual capacity of 60,000 units.

Valued at US$2.49 million, the project is designed to support Zimbabwe’s rail rehabilitation program while also serving regional markets, reducing reliance on imported concrete sleepers, and strengthening local supply chains.

Financial projections indicate a gross profit margin of 34 percent and a net profit margin of 20 percent, with an internal rate of return (IRR) of 14 percent over an 18-month project period. The plant is expected to play a critical role in the revival of the country’s rail network, which is central to the movement of minerals, agricultural produce, and industrial goods.

Green manufacturing meets energy crisis

In the renewable energy and green manufacturing space, the Orangerose Solar Roof Tile Manufacturing Project is positioning itself as a market-driven response to Zimbabwe’s persistent power shortages.

Related Stories

Based in Bulawayo, the US$3 million project will locally manufacture patented solar roof tiles, combining roofing material with embedded solar technology. The plant is targeting a daily output of 600 tiles and projected annual revenues of US$3.6 million.

While margins are relatively modest, the project boasts a strong internal rate of return of 33.3 percent and a payback period of just eight months, underscoring its commercial appeal in a country where households, businesses, and property developers are aggressively turning to off-grid energy solutions.

Billion-dollar industrial bets

ZIDA is also promoting mega-scale industrial projects aimed at positioning Zimbabwe as a regional heavy-industry player.

Chief among them is the Verify Coal-to-Fertilizer Plant with Net Zero Emissions, a US$1.1 billion industrial complex that will produce 520,000 tonnes of urea and ammonium nitrate annually. The project integrates carbon capture technology, renewable energy, and low-emission systems, aligning with global decarbonization trends while addressing fertilizer shortages in Southern Africa.

If implemented, the plant would anchor Zimbabwe’s ambition to become a major fertilizer producer, reduce import dependence, and stabilize agricultural input supplies for the region.

Overall, ZIDA’s 2025 investment pipeline signals a shift from small-scale opportunistic projects towards bankable, industrial-scale ventures designed to deliver long-term economic transformation.

With sectors ranging from rail infrastructure and renewable energy to fertilizer and advanced manufacturing, Zimbabwe is effectively putting its industrial future on the investment table.

Leave Comments