By Nyashadzashe Ndoro - Chief Reporter

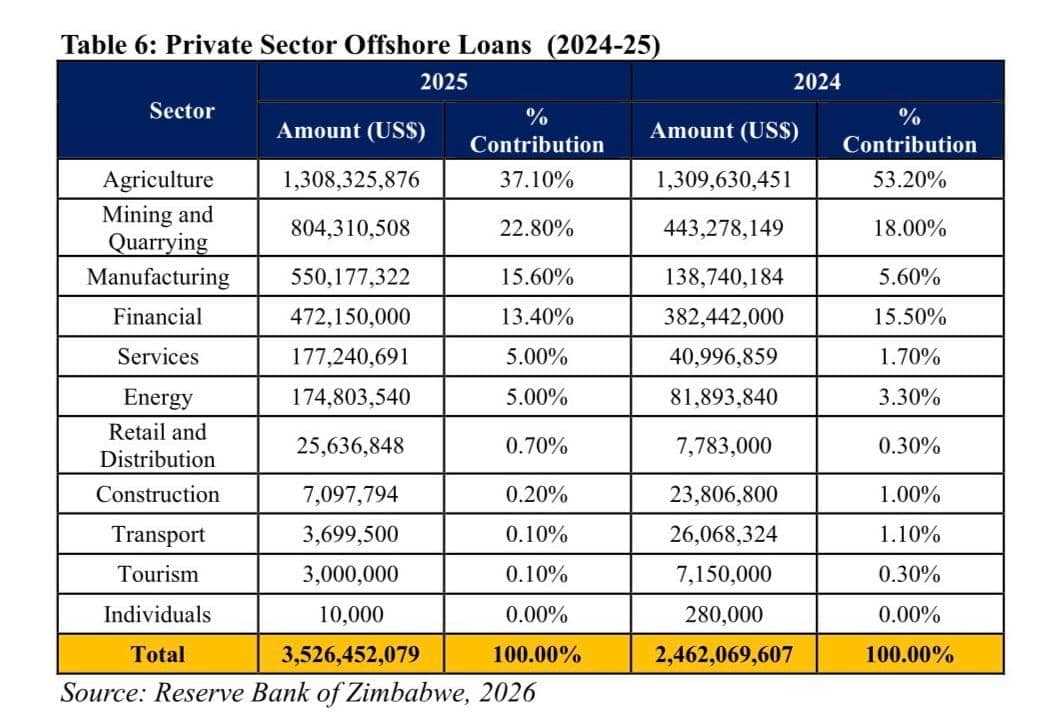

NMBZ Holdings has secured a US$50 million line of credit during the first half of 2025 to strengthen its capacity to support key sectors of the economy, including mining, agriculture, tourism and manufacturing.

The facility is being drawn down to meet long-term financing needs of corporate clients, particularly exporters.

"We are in the process of drawing down on a US$50 million line of credit which was concluded during the period under review. Except for a few companies which have fallen into distress and are being managed, asset quality remains strong. supported by disciplined credit practices and proactive risk management," the company stated.

Related Stories

The bank’s loan book expanded by 18% to ZWG3.4 billion as at 30 June 2025, up from ZWG2.9 billion at year-end 2024, largely driven by foreign credit lines. Despite this growth, operating income fell to ZWG915.8 million from ZWG1.2 billion in the prior period, reflecting pressure from restructuring costs and weaker foreign exchange gains.

Profit for the period stood at ZWG77.8 million, down from ZWG127.2 million in the first half of 2024, while total comprehensive income nearly doubled to ZWG98.9 million compared to ZWG56.1 million a year earlier. Total assets grew to ZWG7.8 billion from ZWG7.4 billion at the end of December 2024, supported by an increase in deposits.

The group maintained a strong capital adequacy ratio of 24.99%, well above the regulatory minimum of 12%, and remained compliant with the minimum US$30 million capital requirement. Liquidity ratios were also consistently above the 30% statutory minimum.

NMBZ said it is pursuing digital expansion and sustainable finance as strategic priorities. Its fintech arm, Xplug Solutions, continued regional expansion, rolling out automation and digital banking solutions in Rwanda, Mozambique, Tanzania and Uganda. Locally, the bank expanded agency banking coverage to more than 200 outlets nationwide and invested in branch refurbishments.

Looking ahead, management said the group is well-positioned to leverage macroeconomic stability and projected 6% national growth in 2025. It plans to deepen green finance initiatives and roll out an upgraded digital platform, NMBConnect, in the second half of the year.

Leave Comments