Construction materials manufacturer Turnall Holdings Limited says it has significantly reduced its losses for the half-year endedended 30, 2025, despite a decline in revenue compared to the same period last year.

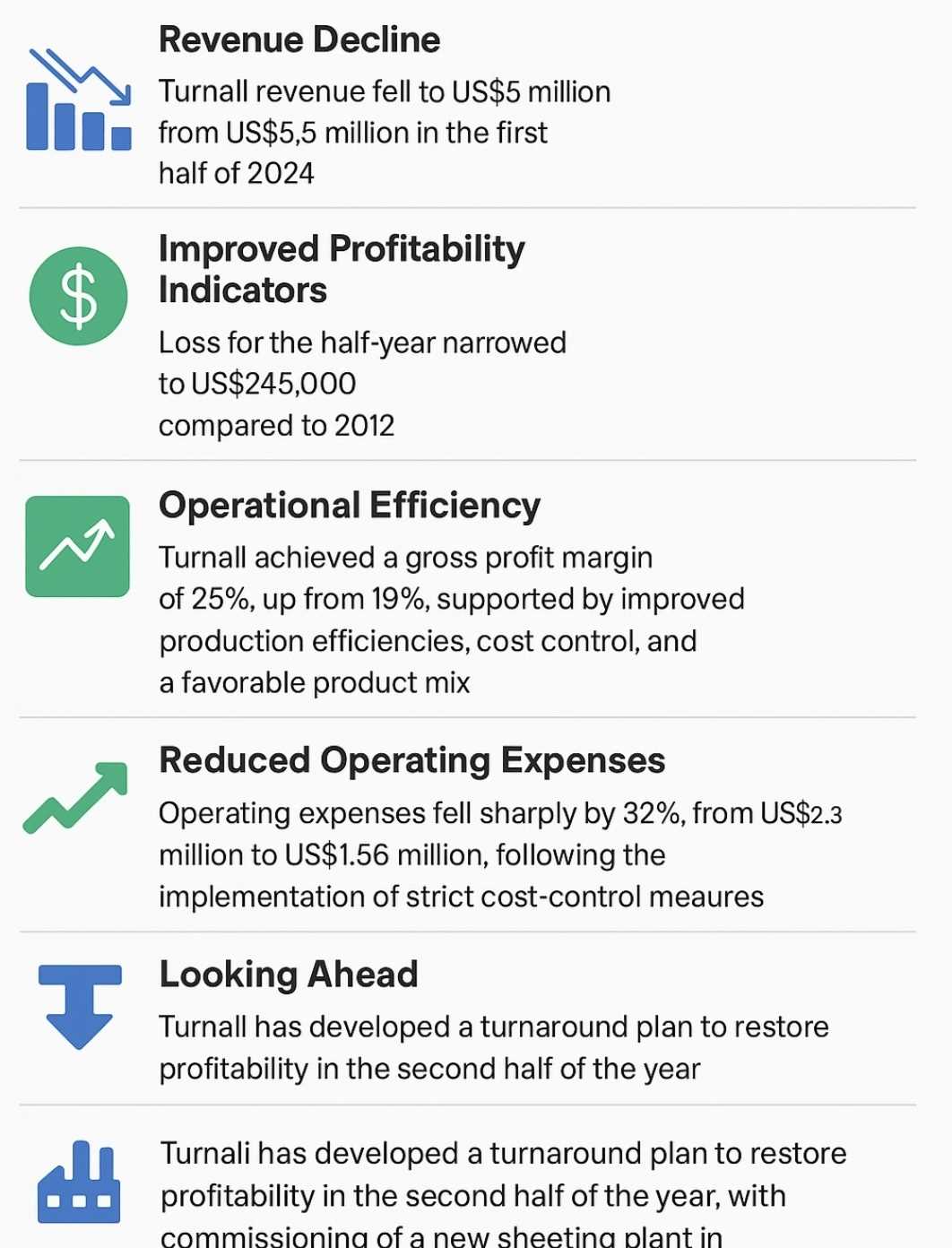

According to the company’s financial results, revenue fell to US$5 million, down from US$5.5 million recorded in the first half of 2024. The decline was attributed to constrained production caused by power outages and limited working capital.

However, the company managed to improve profitability indicators, with its loss for the half-year narrowing to US$245,000, compared to US$1.2 million in 2024.

Board chairman Grenville Hampshire said the first half of the year was marked by a generally stable operating environment, supported by the Reserve Bank of Zimbabwe’s tight monetary policy stance and increased diaspora remittances.

“The business operating environment for the first half of the year was generally stable as the Central Bank continued to maintain a tight monetary policy stance,” said Hampshire.

“Record-breaking tobacco marketing, improved mining activity, and increased diaspora remittances contributed to the positive operating environment.”

He said the stable exchange rate between the official and parallel markets helped minimize price distortions, while inflation also remained largely contained.

Despite the revenue drop, Turnall achieved stronger operational efficiency. The company’s gross profit margin rose to 25%, up from 19% in the previous period, supported by improved production efficiencies, cost control, and a favourable product mix.

“The improvement in the gross margin was due to improved production efficiencies, tight cost-containment measures, and a product mix skewed towards high-margin and low-tonnage building products,” Hampshire explained.

Operating expenses fell sharply by 32%, from US$2.3 million to US$1.56 million, following the implementation of strict cost-control measures.

Related Stories

“Management is implementing cost-containment strategies, and these are starting to bear fruit as our cost structure is now aligned to the current level of activity,” he said.

Turnall also reported improved cash generation, with operating cash flows amounting to US$406,529, compared to a cash outflow of US$677,682 during the same period last year. This was partly due to better working capital management and the settlement of trade payables.

“The business generated positive cash flows mainly due to the improved management of working capital,” Hampshire noted.

“We also secured additional loan facilities from shareholders and a financial institution during the period, which led to an increase in finance costs.”

Looking ahead, Hampshire said management had developed a turnaround plan expected to restore profitability in the second half of the year, with the commissioning of a new sheeting plant in the fourth quarter of 2025 set to boost output.

“The Board is confident that the Group will revert to profitability,” he said. “Significant improvements in margins are expected in the second half of the year, mainly from procurement savings and enhanced production efficiencies.”

He also reaffirmed Turnall’s commitment to environmental and corporate governance standards, noting the company’s adherence to ISO14001 and ISO9001 certifications.

“We continue to comply with relevant legislative requirements and maintain a sustainability reporting framework as part of our business model,” he said.

Hampshire concluded by expressing appreciation to shareholders, employees, and partners for their continued support during the turnaround journey.

“I would like to express my appreciation to all our stakeholders, fellow board members, management, and staff for their continued support,” he said.

Turnall expects the second half of the year to mark a stronger recovery phase as new production lines come online and market demand improves.

Leave Comments