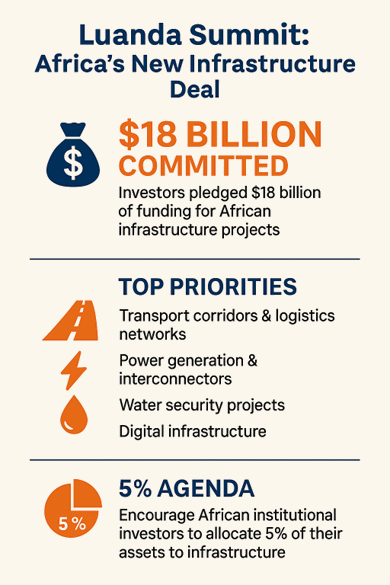

After decades of borrowing to build, Africa is now shifting toward financing itself — and attracting investment on its own terms, with US$18 billion pledged toward African infrastructure at the close of the III Financing Summit for Africa’s Infrastructure Development Investors in Luanda last week.

“For too long Africa’s immense financial power — our savings, our sovereign wealth, our institutional capital — has been passive in the story of our own development,” said AUDA-NEPAD CEO Nardos Bekele-Thomas. “That chapter, hopefully, is being closed now.”

The funds will go to 38 bankable projects and 11 regional integration projects under the Programme for Infrastructure Development in Africa (PIDA) — the African Union’s blueprint for connecting the continent through transport, energy, and digital networks.

The African Union Development Agency-NEPAD (AUDA-NEPAD) and the African Union Commission (AUC) co-hosted the three-day summit under the theme “Capital, Corridors, Trade: Investing in Infrastructure for the AfCFTA and Shared Prosperity.” Over 2,000 leaders, investors and development partners attended, representing a unified front for economic self-determination.

The new funding commitments are designed to unlock the full potential of the African Continental Free Trade Area (AfCFTA) — the world’s largest free trade zone, connecting 1.4 billion people across 55 countries.

The AU says it aims to correct the “market failure” that leaves many viable projects unfunded at early stages. The plan emphasizes project preparation, ensuring a continuous pipeline of investable infrastructure — from transport corridors to energy grids and digital systems.

A key innovation is the 5% Agenda, a policy encouraging African pension funds, insurance firms and sovereign wealth funds to invest 5% of their assets in local infrastructure.

Related Stories

“Our message is simple,” said Bekele-Thomas. “We will match your fiduciary discipline with regulatory clarity and project preparation at scale.”

This approach recognizes that Africa’s wealth isn’t missing — it’s misplaced, often locked in foreign markets earning minimal returns while the continent’s infrastructure deficit widens.

Investors discussed US$43.9 billion worth of opportunities:

- US$25 billion will target transport corridors and logistics networks.

- US$15 billion will fund power generation and interconnectors.

- US$2.7 billion is earmarked for water security projects.

- US$1.2 billion will strengthen digital infrastructure.

AUDA-NEPAD says it will move swiftly to turn these commitments into tangible outcomes. Thirteen PIDA priority projects will be fast-tracked, with progress expected to feature at the African Investment Forum in Morocco in December 2025.

The Summit declaration calls for policy reforms, regulatory harmonisation, and debt restructuring mechanisms to create fiscal space for infrastructure investment. It also endorses a revitalised Presidential Infrastructure Champions Initiative, ensuring that cross-border projects — like trans-African highways and energy corridors — are delivered faster.

AU Commissioner for Infrastructure and Energy Lerato Mataboge summed up the moment:

“Luanda has shown the spirit of pan-African leadership. Africa can, and will, plan, finance and deliver the foundation of its own prosperity.”

Leave Comments