ZimNow Business Desk

At the midpoint of 2025, stats say Zimbabwe is not just surviving—it’s quietly thriving. In his 2025 Mid-Term Budget Review presented yesterday, Finance Minister Mthuli Ncube reported that the country remains firmly on track to meet its 6% GDP growth target, underpinned by inflation control, strong external receipts, and disciplined fiscal management. Combined with numbers released by Zimstat last week, an interesting picture of the Zimbabwean economy is emerging.

But is this momentum real? Or just a statistical flash?

After a shaky currency past, the introduction of the ZiG appears to have steadied the ship. Month-on-month inflation has averaged just 0.5% from January to June. Though annual inflation hit 92.5% in June, the surge is largely due to base effects and is expected to ease going forward.

For once, both price watchers and businesses seem aligned: there’s cautious optimism in the air.

Foreign Currency and Current Account Resilience

Zimbabwe recorded a 30.2% increase in foreign currency receipts between January and May—pulling in US$6 billion, up from US$4.9 billion in the same period last year.

The current account remains in the black, with a US$19.9 million surplus in Q1 2025 and a projected US$621.7 million surplus by year-end. That’s rare in the region—and signals real structural resilience.

Manufacturing and Mining Lead GDP Rankings

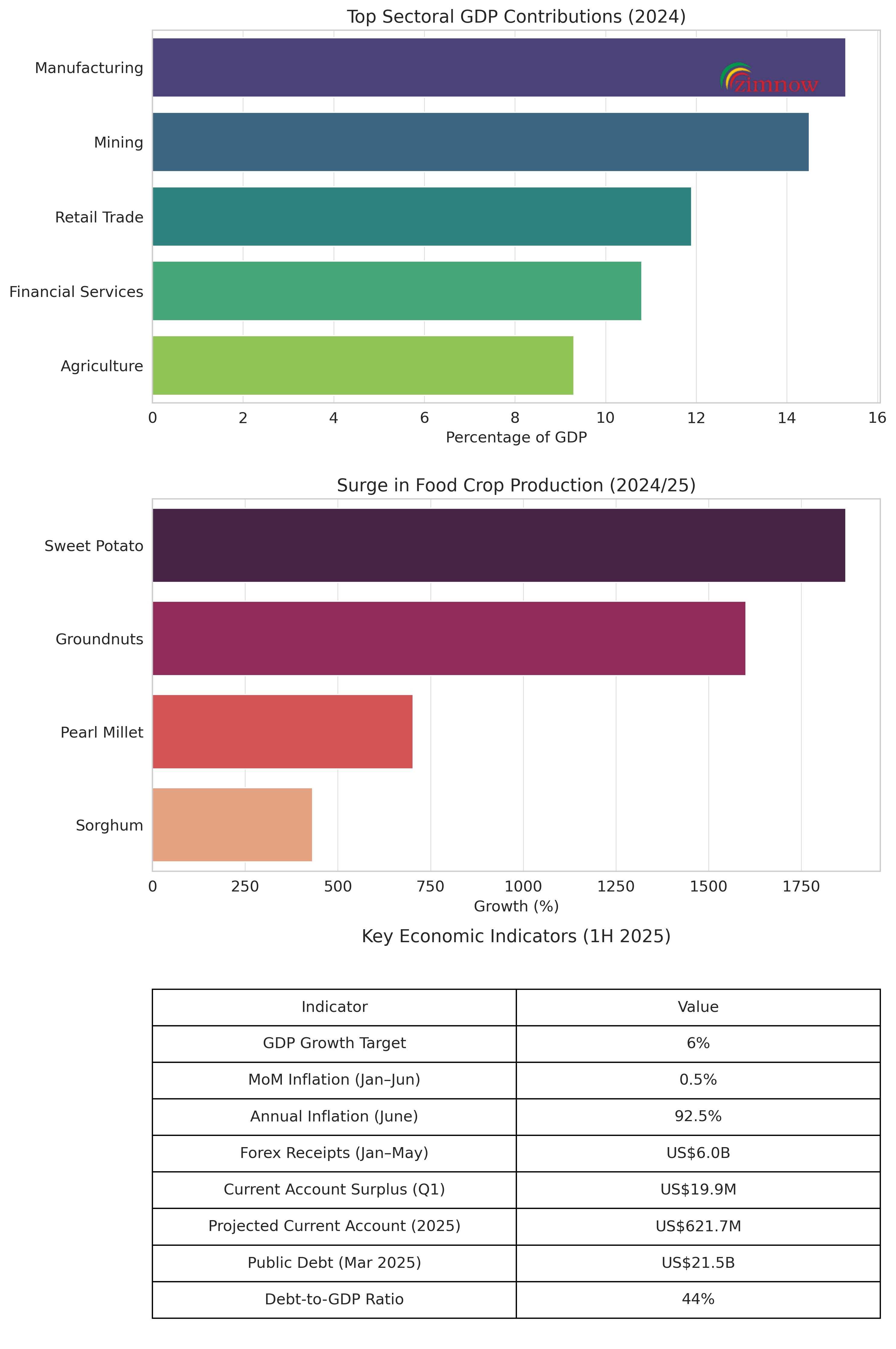

For the first time in decades, manufacturing has overtaken retail and mining as Zimbabwe’s top contributor to GDP, accounting for 15.3% of total output. Mining follows at 14.5%, while retail trade has slipped to 11.9%.

This shift reflects both foreign investment—especially from China—and deliberate policy efforts to drive value addition.

Agriculture’s Stunning Turnaround

Related Stories

Perhaps the most underreported story of the year is Zimbabwe’s food crop boom. A 290% surge in total production has turned 2024/25 into a bumper season. While tobacco and blueberry stories have made it into the news, there is steady growth in other areas, which is significantly contributing to the upliftment of lifestyle standards.

Top-performing crops include:

- Sweet Potato: +1870%

- Groundnuts: +1601%

- Pearl Millet: +703%

- Sorghum: +432%

The implications? Improved food security, lower import dependency, and rural income growth.

Deficit in Check, But Self-Sufficiency Still Far

By June, Zimbabwe had collected ZiG101.2 billion in revenue and spent ZiG98 billion, staying closely aligned with its 2025 budget. The deficit remains minimal at just 0.4% of GDP, a rarity in the region.

Government spending is increasingly targeted, but US$148.1 million in donor assistance supporting key sectors like health, education, and emergency response indicates that self-sufficiency and basic welfare are still visions.

Debt Under Control

According to the figures, Zimbabwe’s total public and publicly guaranteed debt stood at US$21.5 billion in March 2025, with a debt-to-GDP ratio of 44%—well within sustainable limits.

The Big Picture

If the first half of the year is anything to go by, Zimbabwe’s economy is entering a more balanced phase. Growth is no longer driven solely by mining or consumption but by a triangulation of industry, exports, and agriculture.

The challenge now? Sustaining the gains. Power outages, global price shocks, and policy drift remain serious risks.

Leave Comments