Nyashadzashe Ndoro – Chief Reporter

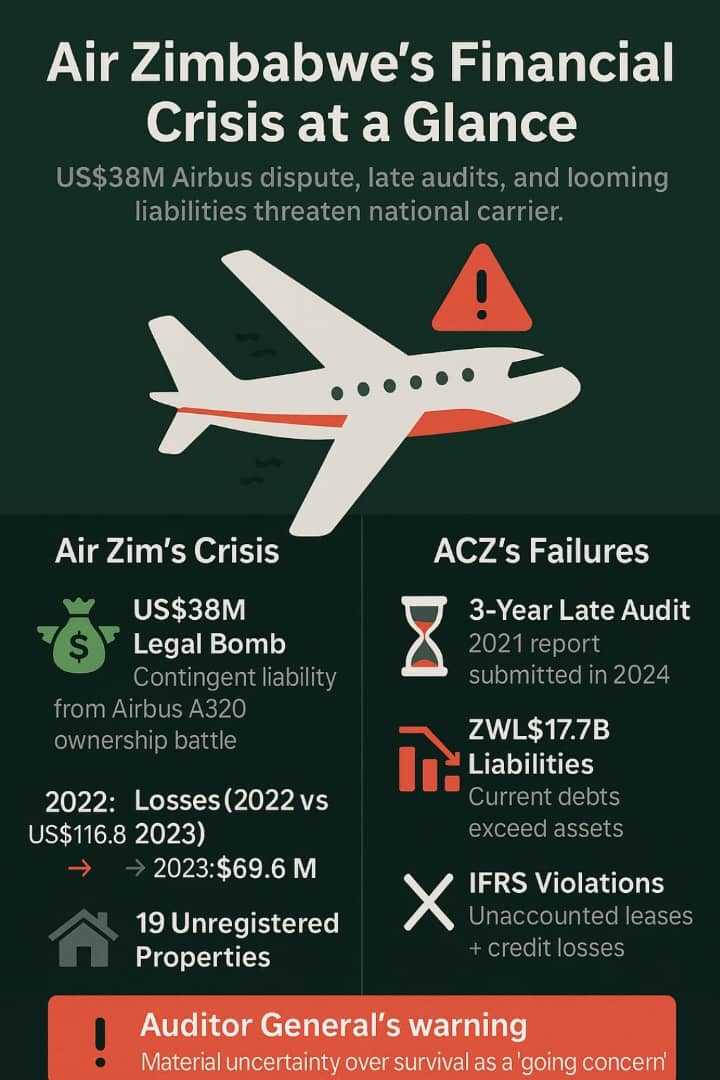

A legal battle over the ownership of two Airbus A320 aircraft has been cited as a significant contributor to the ongoing financial instability at Air Zimbabwe (Pvt) Ltd.

The dispute has resulted in a contingent liability of approximately US$38 million — a key concern highlighted by the Auditor General in the company’s 2022 and 2023 audit reports.

Although the reports issued an unmodified opinion on the financial statements, they prominently featured a “report on going concern,” underscoring a material uncertainty that could cast significant doubt on the airline’s ability to continue operating.

The ownership dispute, combined with accumulated losses and a large net current liability position, paints a troubling picture of the national carrier’s financial health.

The Auditor General’s report revealed that in 2022, Air Zimbabwe had accumulated losses of US$116.8 million, with current liabilities exceeding total assets by US$34.8 million.

By 2023, the situation had slightly improved, with accumulated losses reducing to US$69.6 million and net current liabilities dropping to US$16.5 million. However, the US$38 million contingent liability from the Airbus dispute remained a major concern.

(A contingent liability is a potential financial obligation that may arise in the future, depending on the outcome of a specific event. It's not yet confirmed, but could become actual if certain conditions are met. Examples include lawsuits, guarantees, or warranties.)

“These conditions indicate the existence of a material uncertainty that may cast significant doubt on the company’s ability to continue as a going concern. My opinion is not modified in respect of this matter,” stated Acting Auditor-General Rheah Kujinga.

Beyond the A320 issue, the audit reports for both Air Zimbabwe and the Airports Company of Zimbabwe expose systemic governance and financial management failures across state-owned enterprises.

The Auditor General issued a qualified opinion on ACZ’s 2021 financial statements, citing non-compliance with International Financial Reporting Standards.

Related Stories

The audit found that ACZ failed to properly determine its allowance for credit losses, amounting to ZWL$63 million, neglecting to apply the required probability-weighted expected credit loss model. Additionally, the company did not account for a lease agreement with the Civil Aviation Authority of Zimbabwe for the land it uses — a clear violation of IFRS 16.

Reporting Delays:

ACZ submitted its 2021 financial statements nearly three years late, on July 30, 2024 — a breach of the Public Finance Management Act, which mandates submission within 60 days of the financial year-end. The delay was attributed to the finalization of ACZ’s split from CAAZ.

Like Air Zimbabwe, ACZ also faces going concern issues. The report flagged that the company’s current liabilities exceeded current assets by ZWL$17.7 billion. It also failed to service ZWL$6.8 billion in inherited loans.

Neglected Investment Property:

The airline failed to attract tenants for an investment property due to its poor condition, caused by cash flow constraints. This resulted in a loss of potential revenue.

Unregistered Properties:

Nineteen properties listed in the company’s financial statements were not registered in its name, exposing the airline to possible legal disputes. Management stated that legal counsel had been engaged to regularize ownership.

Late VAT Payments:

Persistent cash flow problems also led to delayed remittance of Value Added Tax, potentially attracting fines and penalties.

Leave Comments