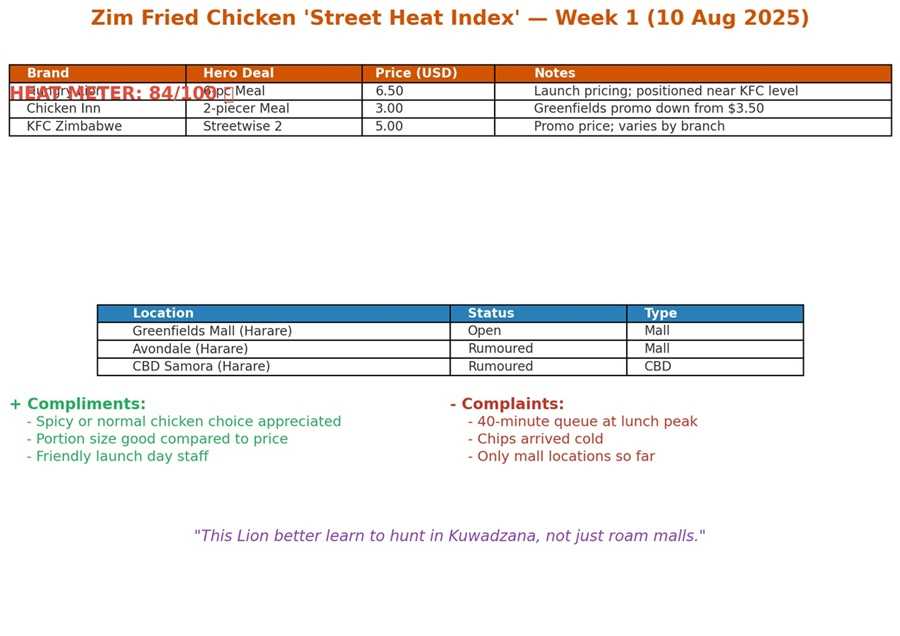

People are excited but not yet converted. The Hungry Lion success can only be judged post-trial when the command loyalty.

The folk wisdom is clear: give me a reliable, tasty sub‑$4 meal near my commute, and I’m yours. And that intelligence is available for all players.

If Hungry Lion keeps hovering around $6–$7, the street will treat it like KFC‑adjacent, and Chicken Inn keeps the weekday stomach share.

What we scanned (public posts only)

- Facebook pages/groups and public posts about the launch/date, reactions, and price chatter.

- X posts cheering/flagging the launch.

- TikTok videos around the Harare opening, menus/specials buzz; some HL-owned posts

- KFC Zim promos (as pricing context), incl. Streetwise offers on IG.

The signals (crowd themes)

1) Real launch hype — queues + curiosity (short‑term trial)

- Multiple posts celebrate the 7 Aug opening at Greenfields, with “finally in Zim” energy and shareable videos. Expect heavy week‑1/2 trial traffic.

2) Competition welcomed (Chicken Inn “had it easy”)

Related Stories

- Public comments frame HL as overdue competition that should discipline pricing and service: “vakauya ne strategy… good for the market”. (Facebook)

3) Menu touches resonate (spicy vs normal choice)

- Customisation (spice choice) is mentioned approvingly—small but sticky UX win vs local incumbents. (Facebook)

4) Price reality check (where HL sits)

- TikTok/IG snippets and in‑store boards circulating show HL launch promos, but meal talk centers around US$6–$7 territory—i.e., near KFC promo band, not Chicken Inn’s everyday 2‑piecer ±US$3–$3.50 line. This fuels the “nice to try, not everyday” vibe. (TikTok, Instagram)

5) KFC answering with visible deals

- KFC’s feed is pushing shareable “Streetwise” bundles and snack deals—useful context: a live promo ceiling that HL must beat or match to win frequency. (Instagram)

6) Footprint curiosity beyond Harare

- Posts and comments ask about smaller towns and commuter‑site placements—audience is watching rollout speed and commuter‑belt reach. (TikTok)

Crowd takeaway by segment

| Segment | What they’re saying (plain English) | Implication |

|---|---|---|

| Value hunters | “We’ll try it, but daily lunch must be <$4.” (Instagram) | HL must field a US$3–$4 anchor (e.g., 2‑piece or burger+chips) to dent Chicken Inn traffic. |

| Occasionals / families | “Opening specials look fun; buckets/bundles?” (TikTok) | Lean into family buckets/weekend bundles; fight KFC on bundle value, not à la carte. |

| Brand explorers | “New brand = new taste; spicy option is cool.” (Facebook) | Keep spice choice loud in comms; it’s a differentiator people notice. |

| Commuter crowd | “Where else besides Greenfields?” (TikTok) | Speed to CBD/terminus/fueling nodes matters more than premium malls. |

Our read (based on what people actually react to)

- Trial is secured by novelty + opening specials.

- Retention hinges on a sub‑$4 hero deal and rapid commuter‑node rollout. Without those, chatter normalises and HL becomes a “treat,” not a habit.

- KFC will keep squeezing with Streetwise promos; Chicken Inn defends by holding its $3–$3.50 2‑piecer benchmark and leaning on convenience/delivery. (Instagram)

What to watch in the comments this coming week

- Screenshots of actual till slips / menu boards showing HL meal pricing in USD and ZiG equivalents.

- Complaints about wait times/stockouts (launch teething) vs. praise for portions.

- Posts announcing second/third sites (especially CBD, Samora, Avondale, Westgate, Bulawayo CBD).

- Direct HL replies on X/TikTok to service issues—how fast/transparent? (Signal of ops discipline.

Leave Comments