Nyashadzashe Ndoro- Chief Reporter

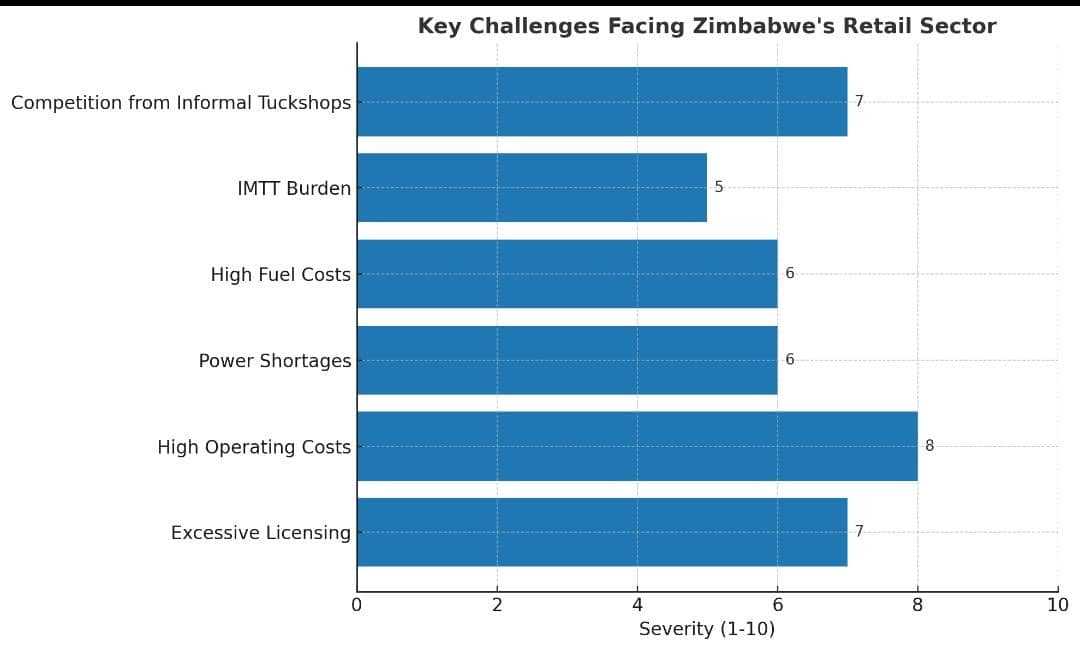

Lawmakers have called on the government to urgently address constraints facing Zimbabwe’s wholesale and retail sector, warning that excessive licensing requirements, high operating costs, and unreliable power supplies are undermining competitiveness and discouraging investment.

This comes at a time when the retail sector in Zimbabwe has been struggling under mounting economic pressures, with many established shops scaling down operations or closing branches altogether.

Rising operational costs driven by frequent power outages, high fuel expenses, and multiple licensing requirements have squeezed profit margins, while increased competition from informal tuckshops has further eroded market share.

Industry observers note that without targeted policy support and measures to ease the cost of doing business, the sector risks continued contraction, undermining its contribution to employment, government revenues, and overall economic growth.

During debate on the Report of the Portfolio Committee on Industry and Commerce on the Impact of the Prevailing Economic Environment on the Wholesale and Retail Industry, Members of Parliament highlighted that the sector, which makes a significant contribution to GDP, employment, and government revenues, continues to struggle under a difficult operating environment.

Committee members said a proliferation of statutory instruments and multiple regulatory permits were creating red tape and hindering the ease of doing business.

Headlands MP Farai Mapfumo argued that in some cases businesses were forced to secure as many as seven permits from different offices to operate legally, a process that discouraged compliance and pushed many traders into the informal economy.

Related Stories

Concerns were also raised over the reliance on generators due to power shortages, with MPs urging authorities to incentivise independent power producers to supply the local market instead of exporting. They also proposed allowing large corporates and retailers to import their own fuel to reduce costs and emissions.

The Intermediated Money Transfer Tax was also cited as a burden on formal businesses, with calls for a review to promote competitiveness. Lawmakers noted that the growing number of informal tuckshops was eroding the market share of established retailers, a trend linked to the difficulties in the formal operating environment.

Industry and Commerce Portfolio Committee Chairperson, Clemence Chiduwa, acknowledged the challenges and said the debate would help refine strategies to strengthen the sector.

He stressed that addressing regulatory bottlenecks and high costs was essential to ensure retail and wholesale operators continue contributing meaningfully to the economy.

"The multiplicity of licences and regulatory challenges was acknowledged even by His Excellency, the President, who said these are presenting serious obstacles to the effective operations of the retail and wholesale sector," the former Deputy Finance Minister stated.

Amid the challenging environment, OK Zimbabwe Limited, the country’s largest retail group, has embarked on a significant asset disposal plan, including the sale of four of its supermarket properties.

The properties on sale include the OK Mbuya Nehanda store, OK Gweru, OK Glen View, and OK Malvern. The company also plans to sell a warehouse and two vacant commercial stands.

Other retailers such as N Richards Group, Spar, Food Lovers, and Pick n Pay have also been significantly affected, resulting in numerous store closures nationwide.

Leave Comments