In today’s governance landscape

Boards can no longer afford to operate as ceremonial bodies that merely endorse management’s proposals.

Stakeholders – from shareholders and employees to regulators and the broader community – now expect boards to actively probe, challenge, and add value to the organisation’s strategic direction.

At the heart of effective governance lies one skill: the art of asking the right questions. When directors ask thoughtful, incisive questions, they not only strengthen oversight but also empower management to think more deeply and strategically.

So, what are the essential questions every director should be asking in the boardroom?

1. On Strategy: Are We Building a Future-Ready Organisation?

Boards must look beyond quarterly results and ask whether the organisation has a sustainable long-term strategy.

Questions to probe include:

What differentiates us in the market, and is it sustainable?

How are we responding to technological disruption and industry shifts?

Does our strategy align with shareholder and stakeholder expectations?

2. On Risk: Do We Truly Understand Our Exposure?

Risk oversight is a core fiduciary duty, yet many boards focus narrowly on financial risks. Directors should broaden the conversation:

What are our top five risks, and how are we mitigating them?

How exposed are we to regulatory, reputational, and cyber risks?

Do we have a crisis response plan, and has it been tested?

3. On Finance: Do the Numbers Tell the Whole Story?

Financial reports are more than balance sheets – they are a window into organisational health. Directors should dig deeper:

Are we generating sustainable cash flows, or masking weaknesses with debt?

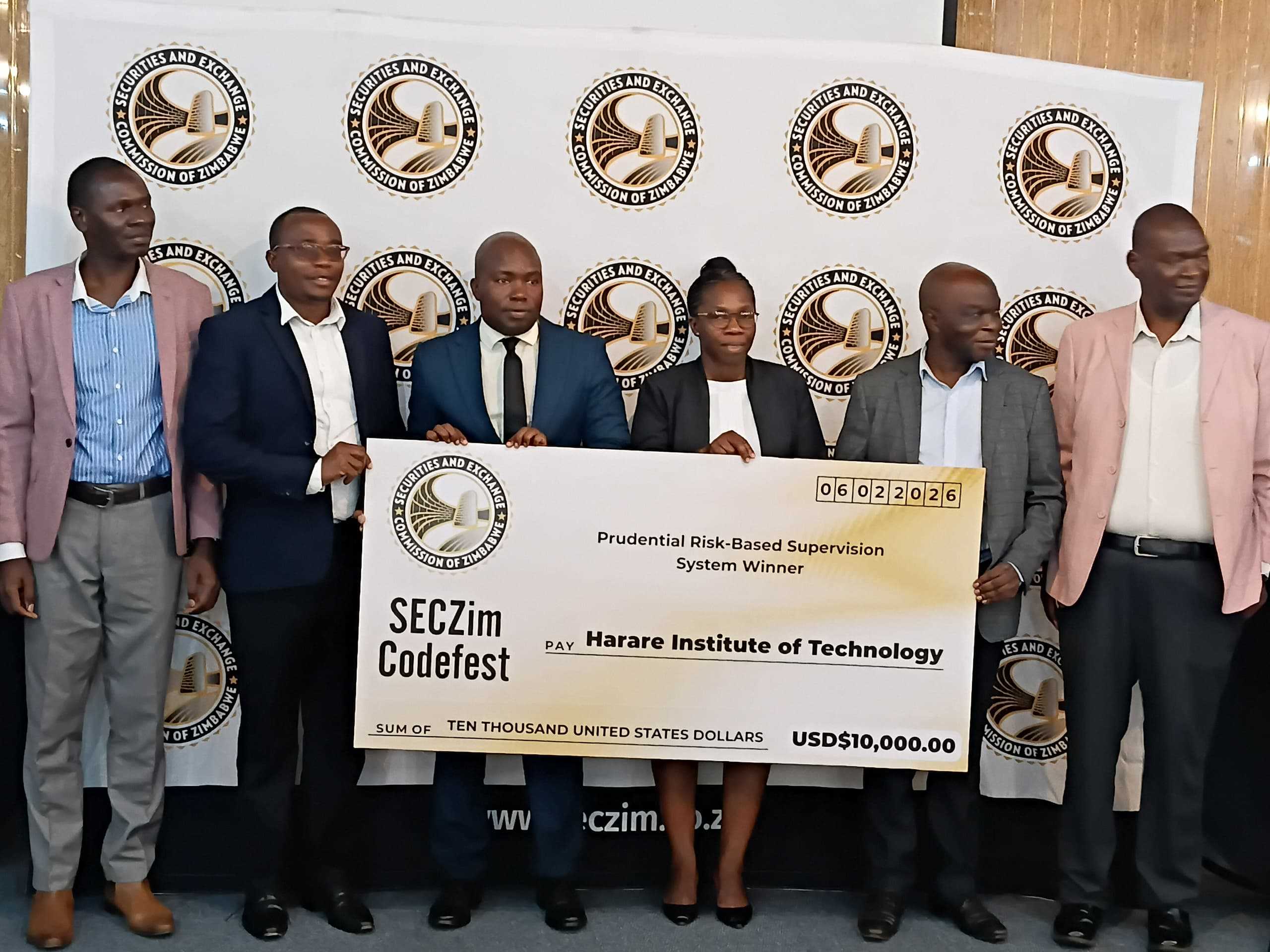

Related Stories

Do our financial assumptions reflect market realities?

How does our performance compare to industry benchmarks?

4. On People and Culture: Do We Have the Right Leadership and Values?

An organisation’s long-term success depends on its people and culture. Boards must ensure these are fit for purpose:

Do we have a clear succession plan for the CEO and key executives?

What does employee engagement data tell us about our culture?

Are our values evident in day-to-day operations, or only on paper?

5. On ESG and Stakeholders: Are We Acting Responsibly?

Environmental, social, and governance considerations are no longer optional. The board’s questions should include:

How are we reducing our environmental footprint?

What social impact are we making in the communities we serve?

Is our governance framework robust enough to withstand scrutiny?

6. On Board Effectiveness: Are We Adding Value or Just Approving Papers?

Boards must be self-reflective, too. Directors should ask:

Do we have the right mix of skills and diversity at the table?

Are we spending enough time on strategy rather than compliance?

How do we measure our effectiveness as a board?

Moving Beyond Rubber-Stamping

Ultimately, good governance is not about micromanaging management, nor is it about being a passive observer.

It is about asking the right questions at the right time – questions that unlock deeper insights, reveal blind spots, and ensure the organisation is prepared for both risks and opportunities.

Asking questions is not a sign of doubt or interference; it is the board’s most powerful tool for fulfilling its fiduciary duty and steering the organisation towards long-term value creation.

Leave Comments