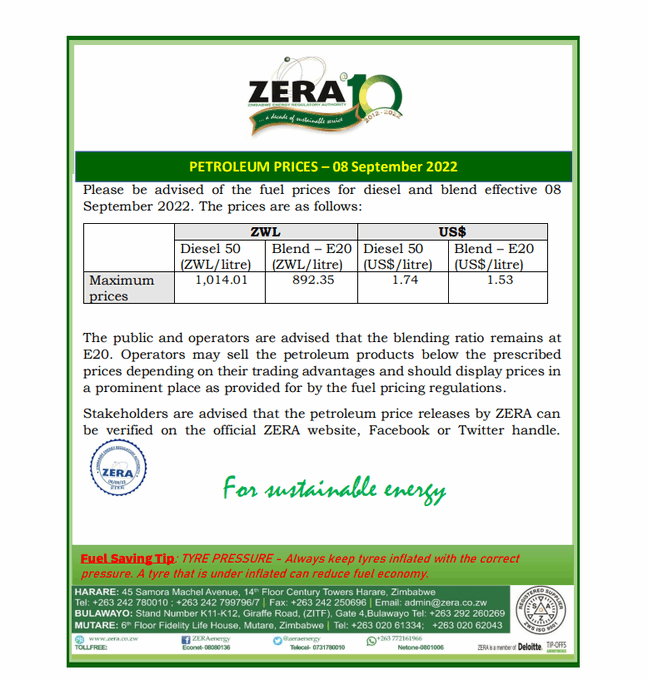

Zimbabwe Energy Regulatory Authority (ZERA) has announced another fuel price decrease with diesel now at US$1.74 a litre and petrol at US$1.53 as world average Brent Crude oil price is now US$ 94 down from US$105 per barrel.

The highest fuel prices per litre in Zimbabwe this year were US$1.88 for diesel and US$1.77 for petrol in June.

This should mean that prices will stabilize if not fall in the short term. That is a relief for many Zimbabweans as they are still watching to see if indeed the monetary authorities have arrested the hyperinflation trend that threatened to cause an economic implosion a few weeks ago.

The Reserve Bank of Zimbabwe has successfully halted and reversed the free fall of the Zimbabwe dollar with several measures including introduction of the Mosi-oa-Tunya gold coins that have mopped up excess liquidity that was fueling the parallel exchange rate.

The world fuel prices coming down is a positive reinforcement for the economy, easing pressure on business and individuals. But Zimbabweans should be ready for possible fuel price hikes before the end of the year and the resultant increases of all goods and services.

What is driving the world fuel prices down at the moment?

Related Stories

The Reduced demand resulting from lockdowns in China are having an impact.

There are also fears of recession and reduced demand in western countries where inflation has bit sharply into spending power forcing people into adjusting lifestyles and driving less.

What will likely trigger upward trend?

But with declining inventories and tight supplies, the situation can reverse rapidly and prices skyrocket once again.

It is also likely that oil heating demand will rise when winter hits places like North America, Europe and parts of Asia.

While China this week announced an indefinite extension to Chengdu’s lockdown, the figure of confirmed Covid-19 cases was down to a 100 giving hope that zero will be reached in the near future and the city of 21 million will be free to move around and consume oil once again, impacting on demand and thus pricing.

Leave Comments