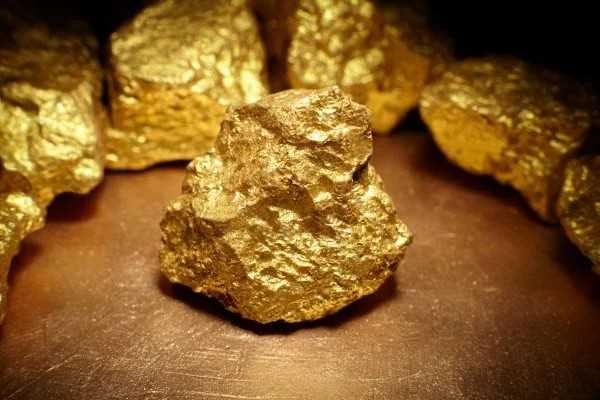

Zimbabwe’s mining industry is experiencing mixed fortunes in 2025, with strong gold performance offset by sharp declines in platinum group metals, lithium, and diamonds, according to the latest sector report from Inter Horizon Securities.

The Ministry of Finance and Economic Development revised the sector’s growth forecast down to 2.9% from 5.3%, citing production headwinds in key minerals.

The report notes: “Forward-looking, prices for PGMs and base metals are expected to remain depressed, while gold prices are likely to remain in favourable territory.”

Global gold prices surged to record highs above US$3,600 per ounce, supporting output and foreign currency receipts. In contrast, PGMs recorded double-digit declines, with platinum and palladium production falling 16% and 18%, respectively, in the first quarter.

Lithium output also fell sharply in early 2025, with exports retreating 60% year-on-year, while diamond export volumes plunged 45%, weighed down by collapsing global prices.

Despite these setbacks, gold continued to dominate Zimbabwe’s external trade, generating 33% of foreign currency receipts and totaling US$6 billion in the first five months of the year.

Related Stories

Deliveries to Fidelity Gold Refinery rose nearly 38% to 28,497 kg by August, driven largely by artisanal and small-scale miners, who accounted for over 70% of output. IH Securities noted: “Small-Scale and Artisanal Miners contributed substantially; 21,011.9 kg out of the 28,497.8 kg delivered to FGR in the eight months to August came from ASM.”

Foreign investment in the mining sector remains robust. The Zimbabwe Investment and Development Agency reported US$651 million in cash inflows in Q1 2025, up from US$434 million in the previous quarter.

However, local funding contributions fell sharply, highlighting continued dependence on external capital.

The report underlined that “the sector remains on a growth path, driven largely by foreign inflows and strategic reinvestments, even as local funding lags behind.”

On the regulatory front, the government gazetted the Mines and Minerals Bill in June, aimed at modernising the legal framework, formalising regulation of strategic minerals, and reinforcing transparency.

A 2% levy on gross sales of lithium, black granite, and quarry stones, introduced under the Finance Act, is also expected to impact revenues.

Leave Comments