Nobesuthu Ndlovu

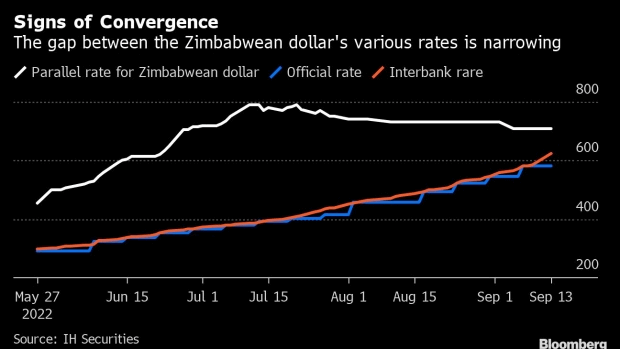

The merging of the official exchange rate with the parallel market should now lead to price reductions, a local economist has predicted.

“It is inescapable. The next wave is that of price reductions and that will cement the stability,” economist and member of the Reserve Bank of Zimbabwe’s monetary policy committee Persistence Gwanyanya told Bloomberg yesterday.

The Zimbabwe dollar official exchange rate of ZW$604,25 against US$1 with the 10 percent mark-up retailers are allowed, brings it almost on par with the black market rate.

The black market rate ranges between ZW$630 and ZW$680, if one can find the dealer with the local currency.

“We have basically converged with an acceptable premium between the alternative and interbank rates. The markets are at equilibrium,” said Gwanyanya.

The RBZ measures to protect the value of the Zimdollar include introduction of the Mosi-oa-Tunya gold coins, tighter regulation of government payments into the market and killing speculation through loans by pushing interest to 200 percent.

Related Stories

https://zimbabwenow.co.zw/articles/283/how-rbz-is-defending-the-zim-dollar

This development should bring custom back to formal retailers whose business was affected by the Zimdollar liquidity crunch.

Mainstream supermarkets were the hardest hit. They experienced a sharp drop in custom.

People who used to change USD on the parallel market then buy from them were now opting to buy from grey market retailer whose USD prices were much cheaper than the official exchange rate that the compliant businesses had to stick to.

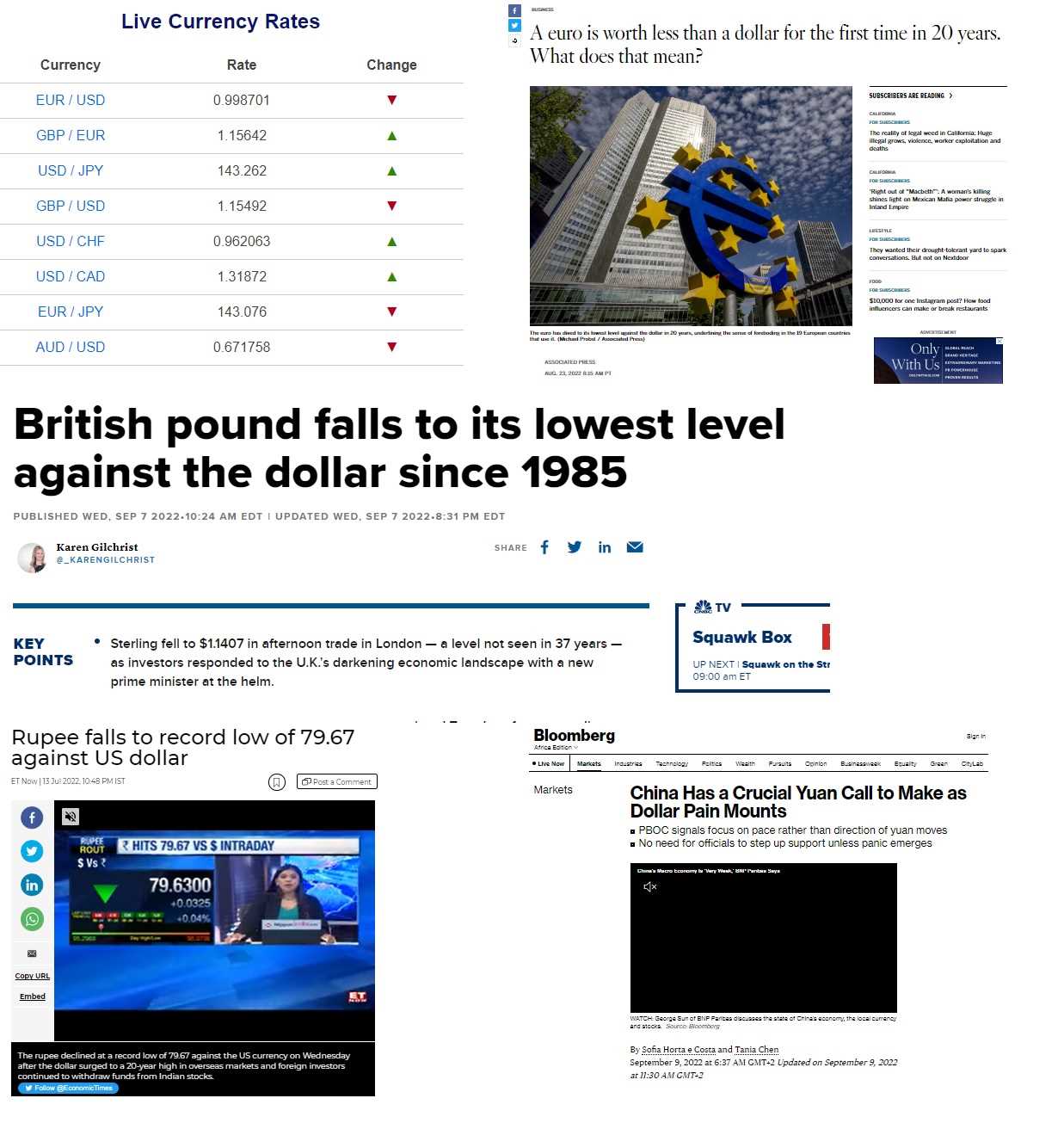

The Zimdollar had gone into free fall with inflation getting out of control. This was the result of both domestic and foreign pressures. With the local factors under control, it now stands a better chance of retaining value against the USD. External pressures include the effects of the Ukraine conflict and currency manipulation by the US monetary authorities which have resulted in almost all currencies across the world have been struggling against the USD.

Economics professor at Harvard University and a former chief economist at the International Monetary Fund Kenneth Rogoff says the dollar has been rising in large part because the Federal Reserve is on track to increase interest rates faster than other major countries.

Leave Comments